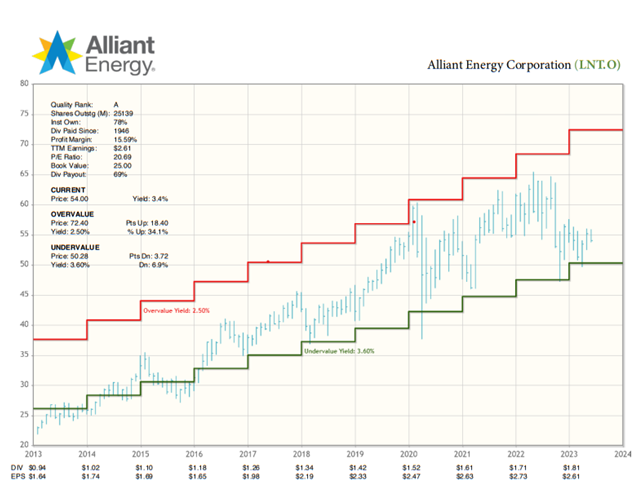

As an investment vehicle, high-quality stocks with long-term track records for consistent, rising profits, and consistent, rising dividends that trade between two repetitive areas of dividend yield offer the least downside price risk and the most upside price potential while providing a growing stream of income. Alliant Energy Corp. (LNT) is one to buy, opines Kelley Wright, editor of Investment Quality Trends.

Twenty-five to thirty stocks, purchased at their historically repetitive low-price/high-yield undervalued area, diversified as equally as possible across the nine or ten major industrial sectors, and held until they reach their historically repetitive high-price/low-yield overvalued area, offer the best approach I know of growing cash and income for current and future cash needs.

LNT is one that’s attractive here. Alliant Energy’s primary focus is to provide regulated electric and natural gas service to approximately 985,000 electric and 425,000 natural gas customers in the Midwest through its two public utility subsidiaries, Interstate Power & Light (IPL) and Wisconsin Power & Light (WPL).

IPL is a public utility engaged principally in the generation and distribution of electricity and the distribution and transportation of natural gas to retail customers in select markets in Iowa. IPL also sells electricity to wholesale customers in Minnesota, Illinois, and Iowa. IPL is also engaged in the generation and distribution of steam for two customers in Cedar Rapids, Iowa.

WPL is a public utility engaged principally in the generation and distribution of electricity and the distribution and transportation of natural gas to retail customers in select markets in Wisconsin.

Alliant’s strategic priorities include making significant investments toward cleaner energy. Alliant ended 2020 with 42% less carbon emissions than 2005 levels, quickly approaching the planned 75% reduction by 2030. This result was largely driven by the completion of the company’s major wind expansion, making Alliant the third largest owner-operator of regulated wind in the US.

Alliant’s growing renewables portfolio provided 27.5% of the company’s power supply in 2021. Alliant plans to eliminate the use of coal for power generation by 2040 and has a goal of reaching net-zero carbon dioxide emissions from electricity generation by 2050.

Recommended Action: Buy LNT