This is the “boringest excitingest” market in history. Never has there been more of a divergence between excitement in the real world and dullness in the stock market. But this too shall pass, writes Jared Dillian, editor of The 10th Man.

I once had a cat who liked movies. His name was Otto—he passed away in 2014 at 15 years old. His favorite movie was The Matrix because there’s lots of action and explosions. All the action on the screen could hold his attention. But if we were watching Masterpiece Theatre or something like that, he’d wander off and entertain himself for a while. Too boring for cats.

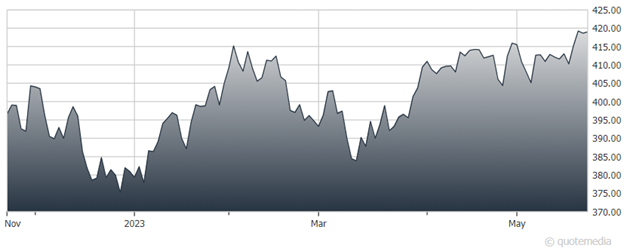

Traders are a bit like my cat Otto. They are adrenaline junkies. They don’t care if the market is going up or down—they just want it to be moving. Well, the S&P 500 is roughly in the same place that it was three weeks ago. The stock market is hardly moving at all.

S&P 500 ETF Trust (SPY)

What’s interesting is that it’s not like there is nothing going on. We have bank failures, the debt ceiling, and increasing tensions with China. But the market doesn’t seem to care. Unchanged, day after day after day.

This isn’t without precedent. There have been plenty of times in history in which the market wasn’t moving much, like in 2017. At least during those periods, there was something to complain about.

Today, there is nothing to complain about. But these days, people are still incredibly bearish, with most stocks above the 200-day moving average. Either investors are right, or the market is right. Guess which way the market is going to resolve?

It’s not as though all financial markets are boring—the bond market is pretty exciting these days, especially in T-bills, with the threat of a debt default in the coming weeks. But stocks? About as exciting as picking out tube socks.

The longer this goes on, the more convinced I am that stocks are going to resolve higher. It’s not as if the stock market doesn’t know about the debt ceiling deadline; it’s on the calendar, and it’s not that far away. I don’t know whether it will get resolved on time (I tend to think that it won’t), but when it does, you’re probably going to have a multi-standard deviation move higher.

Experienced traders know that the market is 90% boredom and 10% sheer terror. If things are boring now, you may as well enjoy it. At some point in the future, things will be exciting, and it probably won’t be the kind of excitement you like. But periods of boredom can last a long time. Pretty much all of 2005 and 2006 were a snoozefest. And you know what happened after that.