Entitlements, which include Social Security and Medicare, represent about 65% of the Federal government’s outlays. Interest on the debt stands at around 12%, but is rising rapidly after declining in the 1990s and first decade of this century. Defense is another 12%. Keep these figures in mind for the future because the US government’s debt problem is NOT going way, advises Adrian Day, editor of Global Analyst.

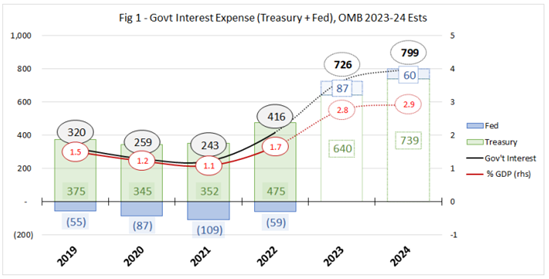

No one is willing to tackle entitlements, the elephant in the budget room, while interest has to be paid. And while it’s not such a large number, interest on the debt has risen dramatically in 2022 and is projected to nearly double again as low-coupon debt is replaced by higher-coupon debt, as can be seen in the graphic. These numbers show why it is so difficult to bring down government spending, and why there is so little wiggle-room in debt-ceiling negotiations like we just witnessed.

It is also why they keep raising the so-called debt ceiling, 78 times since 1960. I say “so-called” because it’s really not much of a ceiling if it is raised every time the government hits it. According to Treasury Department propaganda, the $6.5 trillion the federal government spent in fiscal year 2023, was “to ensure the well-being of the people of the United States”.

This presumably would include half-a-billion to build an arts museum in Nassau, Bahamas. Or $50 million on a “visit Tunisia” tourist campaign. Or $2.1 million on a campaign encouraging rural Ethiopians to wear shoes. This all “to ensure the well-being of the people of the United States”? A million here, a million there, and pretty soon you are talking real money.

It's even worse. The deficit-to-GDP ratio is now 7.3%, the kind of figure one sees in the depth of a recession, not on the cusp of one. Imagine how high that ratio will rise when the denominator moves lower.

When most commentators, including the Treasury itself, talk of the US government debt, they give a number of $31.5 trillion for this year. It is equivalent to 123% of GDP and equates to over $94,000 per person in the US.

That is bad enough. But it excludes unfunded liabilities (mostly Social Security and Medicare) that come to another $100 trillion-plus. That is true government debt.

There is no provision for these liabilities, and they are not on the standard government balance sheet. Stan Druckenmiller puts the total number closer to $200 trillion.

Keep that in mind, especially now that the Leading Economic Index has declined 13 months in a row, the longest stretch since the one that began in April 2007. It is now down 8% from a year ago; it has never dropped this much without a recession.