The Bank of Montreal (BMO), also known and doing business as BMO Financial Group, is a Canadian multinational investment bank and financial services company. We expect operating results over the balance of 2023 to improve with less volatile capital markets, the inclusion of the Bank of the West, and increased net interest income, explains Marty Fridson, editor of Forbes/Fridson Income Securities.

BMO is a leading North American bank and the 8th largest, based on total assets of more than (USD)$900 billion as of 01/31/23.

The bank provides personal and commercial banking, investment banking, wealth management, and investment management services. BMO has a strong U.S. regional bank and capital markets presence through its BMO Harris Bank subsidiary, including BMO Private Bank, and BMO Capital Markets. Additionally, the banking company owns Bank of the West, headquartered in San Francisco.

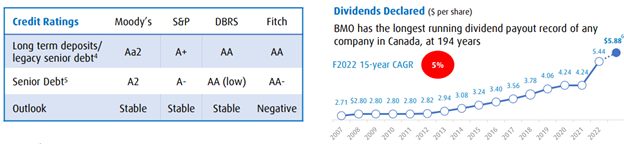

We initially recommended this ADR common stock investment as a Buy for low-risk taxable portfolios in June 2018, seeking a high-quality financial institution offering steady distribution growth. The bank’s USD dividends are qualified and taxed at the 15%-20% rate.

BMO reported 1Q ended 01/31/23 adjusted net income of (CAD)$2.27 billion or (CAD)$3.22 per share. Results topped analysts’ (CAD)$3.16 estimates, despite lower year-over-year results. Operating earnings were adversely affected by volatile markets that cut into wealth management profits, which declined 12%. Additionally, BMO Capital Markets saw a 28% fall in profits tied to market conditions, including sharply higher interest rates, weaker equity prices, and a decline in trading and underwriting activity.

We continue to recommend BMO for low-risk taxable portfolios.

Recommended Action: Buy BMO at $100 or lower.