Every time I talk to someone about investing, this scenario plays out: After I explain what I do for a living, I find them listing the stocks they have bought (or would like to buy) that pay dividends. As much as I try to bite my tongue, I can’t help but say, “Doesn’t that only pay [insert number between 0.5%–3%]?”, recounts Kelly Green, editor of Dividend Digest.

It’s always something like Microsoft (MSFT), Visa (V), or Apple (AAPL). Although all three are great companies that have made investors a lot of money over the years, their recent yields were just 0.81%, 0.79%, and 0.53%, respectively.

I’m not hating on investors who have been holding these shares for a longer period (their current yield is much higher). It’s quite the opposite.

You’ll hear me bring up effective yield time and time again. Remember, effective yield is how hard your money is working based on your specific entry price. Current yield is how hard your money would be working for you if you bought shares today.

So, if you’re holding shares of MSFT, V, and AAPL with an entry price lower than today’s, which means a higher yield, keep collecting that yield. But if you’re looking to buy today, there are much better opportunities.

Last year, companies in the S&P 500 allocated a record $561 billion toward dividend payments for shareholders. And we’re poised for another record year of dividend spending in 2023.

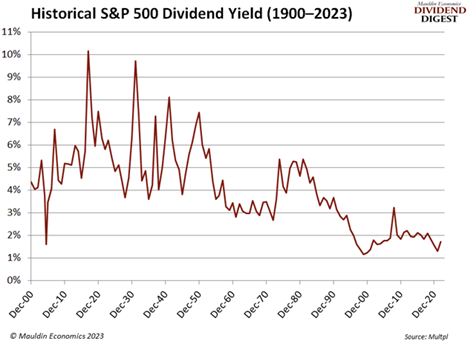

Here’s the bad news: Dividend yields from blue-chip US companies are sitting at all-time lows. Since 1900, we’ve never seen a time when the dividend yield has been below 3% for an extended period. We haven’t even seen 3% since 2008!

Even though the current form of the S&P 500 didn’t appear until 1957, it’s clear that investors are getting paid the lowest they ever have for holding large-cap equities.

Even REITs, which have a legal requirement to pass through 90% or more of their taxable profits, have an average yield of only 3.49%. That’s not enough for the additional risk of these types of investments.

This is why you must have a set of guidelines for the dividends that you’re looking for.

My dividend yield floor is 3%. I won’t look at a company that pays less than that.

Generally, I’m looking for companies that pay out 3%–13%. Once we get around 13%, I start to get nervous. Again, these are just guidelines. A special situation might offer a higher yield, but I would want to watch it closely.

Getting even more specific, a good guideline for big, stable blue chips that you could hold forever and still get paid would be 3%–5%.