Thanks to a boom in tech stocks that was sparked by NVIDIA’s (NVDA) stunning earnings call a few weeks ago, investors have certainly been given a lot more reasons to sing rather than cry lately. As for Apple (AAPL), if I had a nickel for every time I have been asked “Why do you still own Apple – aren’t its best days behind it?" over the years, I would be retired by now, shares Nate Pile, editor of Nate’s Notes.

Naturally, the market’s move higher has left investors wondering what to do next. First off, I want to point out that all five of the major indices I use to gauge the health of the overall market are continuing to flash “bull market” signals for us. Consequently, I am once again encouraging you to remain as fully invested as you can comfortably be while still sleeping easy at night when it comes to positioning your portfolio.

While there is certainly a possibility that things will get “crazy stupid” before all is said and done (and we can only hope that they do, as it is during such market frenzies that we often get to make the most money), the fact of the matter is that the current situation is not even close to what we saw as the dotcom bubble was reaching its peak back in late 1999 and early 2000.

Apple (AAPL)

As for Apple, yes, I think Apple's new headset will both a) come down dramatically in price and b) become a significant contributor to the company’s bottom line as time goes by. So, no, I do not believe Apple “laid an egg” with its introduction recently.

And while it’s possible Apple will mismanage this opportunity, I believe the odds are extremely good that it will instead end up being one of the dominant players in the space.

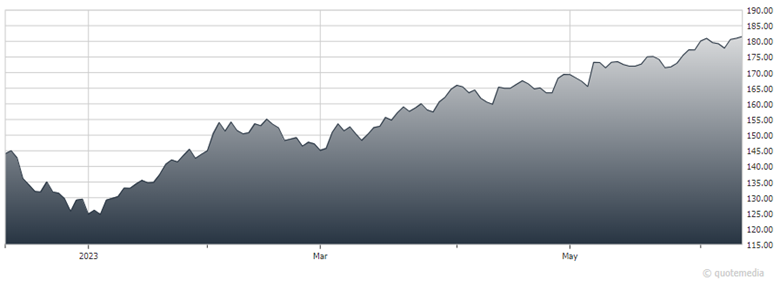

Meanwhile, Apple’s stock has continued to climb in a very linear and orderly fashion...and, while I am in no way complaining about the price action, I have to admit that it does give me some pause for concern that the stock has not really gone through any meaningful consolidation periods yet as part of the rally it has experienced.

That being said, because we already locked in some profits last month, I am content just sitting tight this month. AAPL is a strong buy under $150 and a buy under $175.

Recommended Action: Buy AAPL.