Federal Realty Investment Trust (FRT) is a real estate investment trust that specializes in high-end retail and residence properties in the US. The trust develops and redevelops properties primarily in high-cost coastal markets, which gives it strong moats in terms of occupancy rates and pricing power, writes Ben Reynolds, editor of Top 10 REITs.

Federal Realty has grown to just over 100 properties across the country, collectively making up about 26 million square feet. The trust is also a Dividend King, having raised its payout to shareholders for 55 consecutive years. Federal Realty trades with a market cap of about $8 billion and produces around $1.1 billion in revenue.

The trust posted first-quarter earnings on May 4 and results were ahead of expectations. The trust noted funds from operations per share (FFOPS) came to $1.59, which beat the year-ago period by nine cents, and expectations by two cents. Revenue was up more than 6% year-over-year to $273 million but fell short of expectations at $276 million.

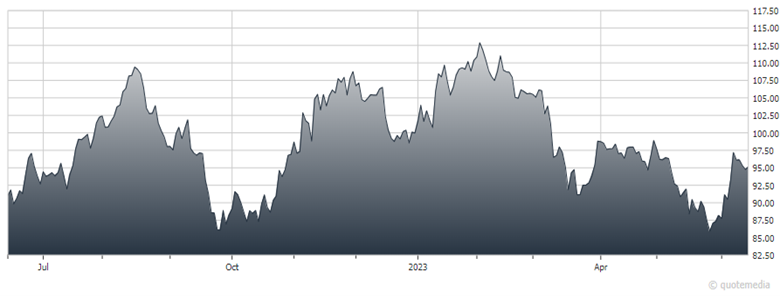

Federal Realty Investment Trust (FRT)

Comparable property operating income growth was 3.6% in the first quarter, which is akin to same-store sales for a retailer. The trust noted occupancy was 92.6% in the first quarter, 3.6% better than last year’s Q1. Federal Realty reaffirmed guidance for 2023 of FFOPS in the range of $6.38 to $6.58. We see $6.46, roughly in the middle of the guidance range.

Dividend safety has been a hallmark of Federal Realty over the past five decades. The trust has one of the longest dividend-increase streaks in the entire market, and the longest among REITs.

The payout ratio was quite elevated during the tough times of the pandemic, but with this year’s guidance for FFO, the payout ratio is back to a normalized level under 70%. We note that any REIT is subject to recession risk, and Federal Realty is no different. However, we also note it has weathered several recessions – some of them severe – in the past 50 years, and it has always managed to raise its dividend.

We see growth from current levels as fairly modest, at just 4.4%. However, that’s not dissimilar to past growth numbers, and it is good enough to produce dividend increases for many years to come. We think comparable property revenue growth will be the primary driver of FFO growth going forward, as new property investments have slowed significantly.

We forecast 8.4% total returns looking forward, as the trust has an ample 4.5% dividend yield, 4.4% projected annual growth, and a very small negative impact from valuation multiple changes, as shares are just slightly over our fair value estimate now.

Recommended Action: Buy FRT.