A consistent message of Income Securities Investor is the importance of diversifying by asset class. But the benefits depend on good security selection. Closed-end fund (CEFs) offer a case in point and one we like here is PIMCO Energy & Tactical Credit Opportunities Fund (NRGX), explains Marty Fridson, editor of Forbes/Fridson Income Securities.

Lofty yields are an obvious appeal of CEFs. Leverage (use of borrowed funds) can boost a CEF’s yield well above the rate of current income on its underlying assets. For example, the average indicated yield on the closed-end funds we’ve recommended was 9.46% as of May 31. That compared with a yield on the same date of 8.64% on below-investment-grade (BIG) corporate bonds, as reported by ICE Indices, LLC.

In fixed income, yield is what’s promised; total return is what you get. Individual CEFs’ performance may diverge radically from the group average, according to their managers’ skills and strategies. Your results in the CEF category will depend on the particular CEF(s) that you select.

PIMCO Energy & Tactical Credit Opportunities Fund (NRGX)

NRGX’s investment objective is total return first and secondarily to provide high current income. The fund is rated five stars by Morningstar.

NRGX’s portfolio holdings are largely tied to energy. The fund typically deploys at least 66% of its net assets in energy investments and has a flexible strategy, investing in opportunities across the full value chain and capital structure of the energy markets. This fund intends to terminate on 01/29/31, provided the Dissolution Date is not extended by the Board.

As of 04/30/23, asset allocation was dominated by Equities (63.8%), followed by US Government Related Securities (17.8%) and High Yield (8.5%). The top sectors based on market value, were led by Pipelines (56.11%) and Exploration & Production (10.03%).

Top portfolio holdings as of 03/31/23 included Venture Global LNG (11.71%), Targa Resources Corp. (4.60%), Cheniere Energy (4.44%), Williams Companies (4.43%), and Chesapeake Energy (3.55%). Total return performance was very strong in 2021 and 2022, as energy prices rose sharply and remained high.

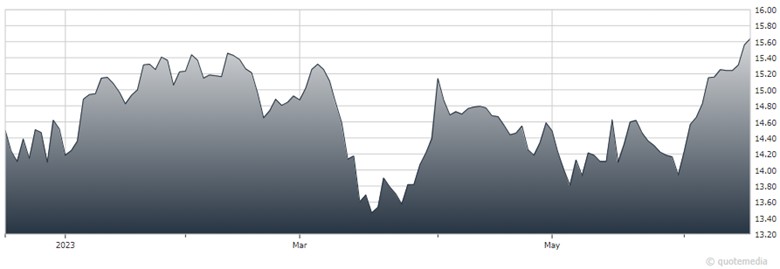

NRGX’s market price total return for the year-to-date period ended 05/31/23 was -3.95% with energy prices and related investments declining from record highs in 2022. Distributions are variable and consist of ordinary income, net capital gains, and return of capital. This investment is suitable for medium- to high-risk portfolios.

Recommended Action: Buy NRGX.