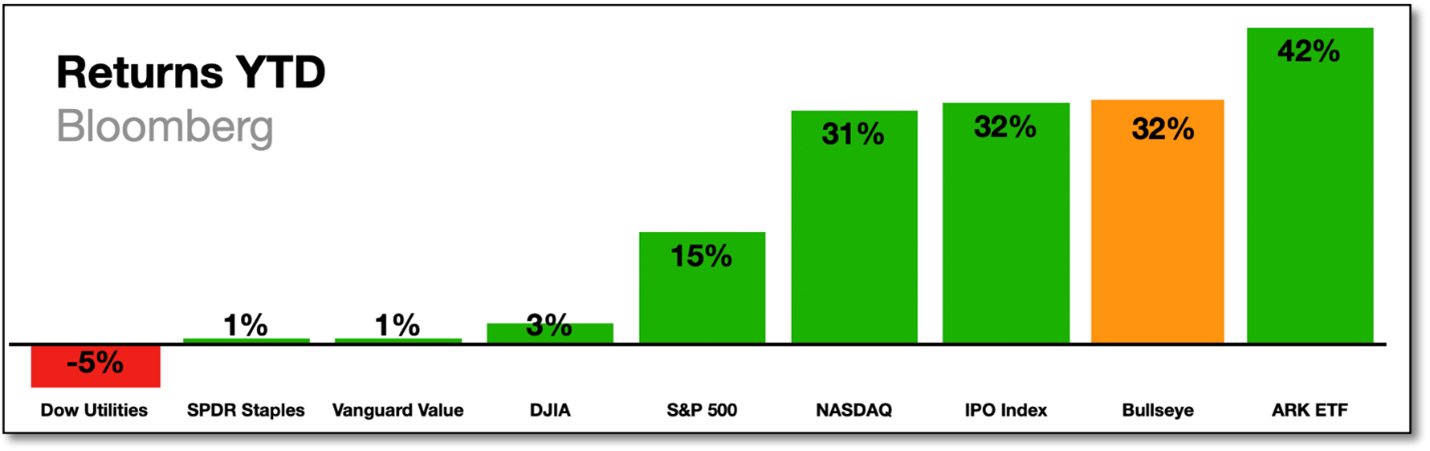

Stocks are rising for a third consecutive quarter despite ongoing uncertainty and residual bearishness. The narrative around inflation, rates, and policy continues to improve as employment remains resilient. I call this the “Most Hated Rally Ever” – because the train has left the station and no one is on it, notew Adam Johnson, editor of Bullseye Brief.

The Nasdaq is up 31% YTD, yet short interest in stock and bond futures remains near all-time highs. Inflation is falling, rate hikes are over, earnings are better than feared, people are employed, and we have a debt deal. What are the bears waiting for?

Meanwhile, retail investors are holding record amounts of cash according to the monthly Bank of America survey, while professional traders are short more stock and bond futures than they were in 2008 (CFTC COT report).

As retail investors decide to return to stocks, and speculators are forced to cover, stocks will trend higher. If you’re waiting for a pullback, you risk missing out entirely. If you’re sitting on cash, put at least half the money to work now. Split the remaining amount into thirds and deploy it over the next several months. That takes the stress out of being “all-in” or waiting “for the dip.”

What about the Bear Case? Are there any warning signs that the current rally is just a blip?

There are always reasons to sit on the sidelines in cash, and I’ll give you two…though to be clear, Bullseye is fully invested.

First, breadth is weak. There are roughly the same number of Advancers as Decliners on any given day, even though the S&P 500 Index just rose to a new 52-week high. This is becuase Big Tech is leading. The rally needs to broaden out in order to be durable.

Second, the yield curve remains inverted for a twelfth month, the longest such stretch since 1981 and a clear signal of stress in the system. As inflation continues to recede, short-term rates should normalize, meaning credit will loosen. This process is taking longer than I would like.

That said, I am an optimist by nature, which is a healthy way to approach both life and investing. Twelve months from now, I believe we’ll look back and realize we could have bought just about anything. FAANG has led thus far, but the rally is beginning to broaden out. Watch small caps, they are still down a lot, but they’re beginning to outperform on up days.

Big-cap technology is strongest sector YTD, having switched places with Financials – now the worst performing group following several failures a few months ago. I own several financials and expect they’ll recover given stabilization for both rates and policy.

Biotech remains pressured, as do all-cash-burning growth companies in need of financing, but my little stocks are re-inflating (JOBY, SOFI, etc). Thanks to the Artificial Intelligence land grab, semiconductors are on fire (ACL, NVDA), and I believe they have room to run.