There is one retail chain that thrives in rural America and lives by the old general store tagline: “If we ain’t got it, you don’t need it!” Dollar General (DG) proudly refers to itself as America’s General Store, and its shares are compelling here, writes Hilary Kramer, editor of Value Authority.

The old-fashioned general store invokes a bit of nostalgia for simpler times in the US when people would gather for the latest town gossip and shop for necessities. There are still general stores littered across the US (complete with penny candy and groceries), but most doors have shuttered with big box stores like WalMart (WMT) and Target (TGT). DG is an exception.

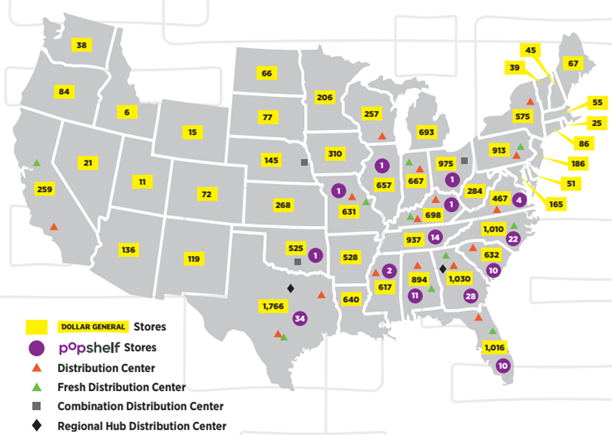

Founded in 1939, Dollar General now operates more than 19,000 stores in the US, and it recently opened its first store in Mexico. The company is a customer-focused retailer, offering large discounts compared to its retail competitors on well-known brand names.

Dollar General’s aggressive pricing is enabled by operating no-thrill stores with an average size of 8,500 square feet in lower-cost small towns with populations under 20,000. The company also sells its own private-label brands that offer consumers an even greater value.

DG has held onto much of the market share gained during the pandemic. After earning $6.64 a share in 2019 (January 31, 2020, fiscal year), EPS soared to $10.62 in 2020 and retreated just slightly to $10.17 in 2021 despite the difficult comparisons.

Last year, aided by an extra week in the fiscal year, growth resumed. Sales were up 10.6%, with comparable store sales up 4.3%. DG also added 1,039 new stores in the fiscal year. Margins narrowed on higher product costs due to supply chain issues, and higher labor costs, but EPS still increased 4% to $10.68 a share.

Despite the generally solid results, the stock had been under pressure since November, as sales were somewhat below expectations. We then saw investor capitulation recently when the company announced first-quarter 2023 results.

First-quarter EPS were $2.34, vs. $2.41 last year, which was $0.04 below expectations. Sales increased 6.8% and same store sales rose 1.6%, as labor, depreciation, and interest costs all rose at a greater rate than sales. In addition, guidance for the current fiscal year was lowered.

However, I do believe the over 20% decline in the stock we saw in the shares following the earnings report is an overreaction. The stock is now selling for the same price it was prior to the pandemic, with the company getting no credit for the increase in earnings power post pandemic. Management is reducing the rate of store expansion, which will help ease the margins pressure near-term. In my opinion, nothing has happened that challenges the long-term success of the company’s business model.

Recommended Action: Buy DG.