Despite ongoing uncertainty surrounding a possible recession, exacerbated by a still hawkish-sounding Fed, an earnings recession, narrow S&P 500 leadership, and an array of steeply inverted yield curves, the equity markets continue to climb a wall of worry, notes Sam Stovall, chief investment strategist at CFRA Research.

Indeed, the S&P 500 closed more than 20% above its prior bear market low on June 8, joining the DJIA, Nasdaq-100, and Nasdaq Composite in confirmed bull markets. What’s more, with a surprisingly strong H1 2023 nearly in the books, history suggests, but does not guarantee, that H2 market and sector gains could be equally optimistic.

Indeed, since 1945, while the S&P 500 gained an average of 4.2% during all H2s, rising in price during 69% of all years, whenever the market’s H1 return exceeded 10%, the S&P 500 posted an average H2 advance of 8.0%, and gained in price 82% of the time.

Even with the typically challenging third quarter since 1945, in which the S&P 500 rose in price just 61% of the time versus an average of 67% for all quarters, the market was up 74% of the time in Q3 following positive H1s.

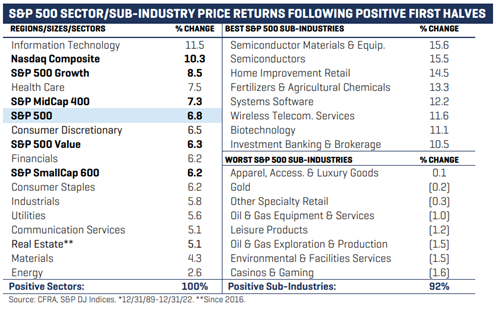

Better still, the subsequent Q4 recorded price gains 87% of the time versus 79% for all years. Finally, since 1990, all sizes, styles, sectors, and 92% of all sub-industries gained in price in H2 following an S&P 500 rise in H1.

Even though there remains the possibility of elevated volatility in Q3, should the Fed hike rates in July and continue to pressure GDP growth and employment trends, CFRA sees investors looking beyond the near-term weakness and focusing on projected improvements in GDP growth and earnings increases in 2024.

As a result, we see share prices closing 2023 at 4,575 and reaching 4,820 by this time next year.