There is a tremendous amount of time devoted to figuring out the “right” time to invest. Whether we’re talking about the market as a whole or an individual security, investors spend an immense amount of effort trying to pick the perfect moments. But an example with one of our Top 10 selections, Broadridge Financial (BR), shows why investors might not want to worry about timing that much, explains Ben Reynolds, editor of Sure Passive Income.

It’s human nature to want to get a good deal. Yet with investing, it’s not about picking the perfect time to invest. Instead, the important part is just getting started and keeping at it over a long period of time.

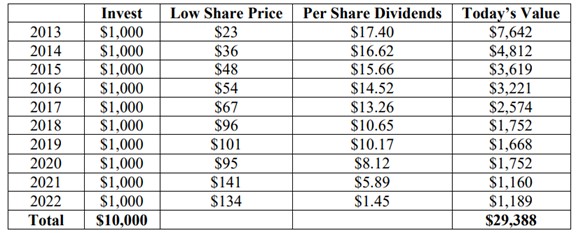

To highlight this idea, we wanted to walk through a hypothetical example on market timing. Imagine you decided to invest $1,000 per year in Broadridge Financial – a Top 10 selection this month - beginning in 2013. We have the benefit of hindsight, so let’s suppose you picked the low monthly share price for 10 years in a row.

This is what that would have looked like:

Had you invested $1,000 at the low share price each year ($10,000 in total), your stake in Broadridge Financial would now be worth over $29,000 (including dividends). That works out to an annualized total return of 17.7% and would have required perfect timing.

Now let’s say your timing was horrible and you picked the WORST possible moment to invest each year. If you had invested at the high each year, your $10,000 starting investment would now be worth nearly $21,000 with dividends included, working out to a compound rate of return of 12.2% per year.

Naturally this is lower than what would have occurred had you invested at the best times. Even so, this is still a very solid result and perhaps surprising considering that you would have been constantly paying a 38% “premium” to the low price each year.

Of course, you’re not going to invest at the absolute high or low price every year. Instead, you will fall somewhere in-between. The point of this exercise is that the difference between investing at the absolute best and absolute worst moments each year may not be as great as you realize.

People spend a lot of time worrying about a 2% higher price this week or hoping for a 10% lower price to buy next month. And yet here the difference was an average of 38% and both scenarios lead to a fine result.

Recommended Action: Buy BR