Our Forecasts & Strategies portfolio includes a lot of big winners, led by the Technology SPDR Fund (XLK), which has advanced 40% this year. Unfortunately, the “Flying Five” portfolio has been holding us back – breakeven for the year, and actually down from a year ago. That’s why I recommend a methodology shift...and buying Chevron (CVX), advises Mark Skousen, editor of Forecasts & Strategies.

We’ve been helped by a large position in Nvidia (NVDA), which has increased over 200% this year. Even our broad-based S&P 500 ETF (SPY) is ahead over 15% in 2023. It includes all the major tech stocks: Apple, Microsoft, Facebook, Google, plus Nvidia and Tesla. We’ve also done well with other names, too.

But the Flying Five strategy needs updating. It used to work well and beat the market most of the time. The basic idea is to buy the five high-dividend-paying Dow stocks with the lowest price. We’ve been recommending it since the early 1990s!

Alas, for the past three years, it has underperformed the market; it’s just not working like it used to. I think it’s time for a change.

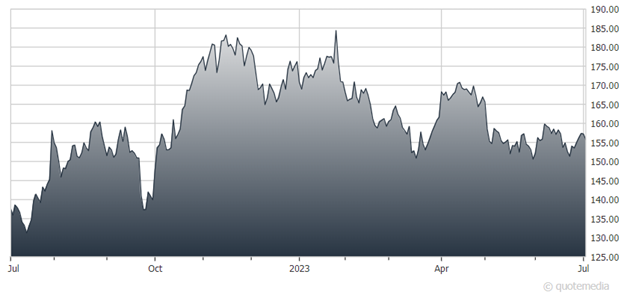

Chevron (CVX)

I’ve come up with my own strategy to pick the NEW Flying Five: The five Dow companies with a consistent rising dividend policy, a dividend yield exceeding 2%, and that is selling cheaply as measured by its price-earnings ratio. Value stocks with low P/E ratios tend to outperform the market over the long run.

Based on the above criteria, I recommend you make the switch into Chevron - and the other four stocks in my Flying Five portfolio.

Recommended Action: Buy CVX.