Noted economist John Kenneth Galbraith once proclaimed, “The only function of economic forecasting is to make astrology look respectable,” while Nobel Prize winning economist Paul Samuelson famously quipped, “The stock market has predicted nine of the last five recessions.” We will leave the economic fretting to others and focus on long-term winners like Leggett & Platt (LEG), writes John Buckingham, editor of The Prudent Speculator.

The economic stats and the performance of equities this year and last have left many scratching their heads. After all, stocks struggled mightily in 2022, even as relatively few thought an economic contraction was in the cards. The probability of recession, per tabulations from Bloomberg, started the year at 15% and did not rise to 50% until August AFTER the US economy had endured two quarters of negative real (inflation-adjusted) GDP growth.

Of course, the arbiter of recessions, the National Bureau of Economic Research, did not count the respective -1.6% and -0.6% real GDP growth readings in Q1/Q2 2022 as an official contraction, even though the definition of recession is accepted to be two consecutive quarters of negative growth.

We remain sanguine as we note that most who expect a recession believe it will be mild, while we think nominal GDP will continue to expand. Since corporate profits are measured in nominal (actual) and not real dollars, we are not surprised that the latest estimates from Standard & Poor’s itself for bottom-up operating EPS for the S&P 500 stand at $217.46 this year and $243.91 in 2024, compared to $196.95 in 2022.

With the Fed seemingly near the end of its tightening cycle and valuations still very attractive, we retain our long-term optimism, especially as the last nine months affirm Lao Tzu’s assertion, “If you do not change direction, you may end up where you are heading.”

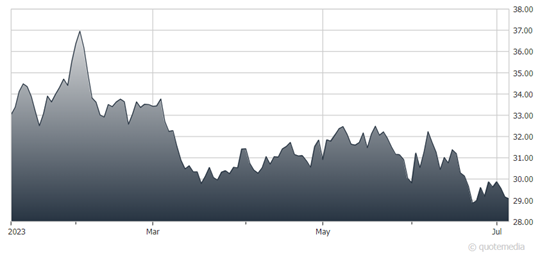

Leggett & Platt (LEG)

As for LEG, it is a diversified manufacturer serving an array of industries including bedding (coils used in mattresses, specialty foam used in bedding and furniture, and mattresses), automotive, aerospace, and steel wire and rod.

With significant ties to housing, and several end markets typically deemed discretionary in nature, recession expectations have likely played a major role in the share performance over the past couple of years. A beneficiary of stay-at-home trends early in the pandemic, LEG was faced with navigating the supply-demand imbalance that ultimately contributed to the current inflationary climate.

Taking a long-term view, the future appears to remain bright as new cars (electric or not) will need new seats in the coming years and the shortage of home supply keeps builders busy. Consequently, we find shares attractive at current levels as we think the bottom line will trough this year and that the company is a leader in most of its markets, with few large competitors.

L&P has increased its dividend for more than 50 consecutive years and the yield is currently above 6%.

Recommended Action: Buy LEG.