In an environment where a lot of people are terrified that the Fed will trigger a recession, it sure feels hot out there. The recent revelation that the job market is still booming is a great example of how what would ordinarily be great news has become toxic in the eyes of investors too terrified of non-zero interest rates. But shocks like that never stop, and when all you can focus on is the shocks, you lose sight of the ultimate reward, counsels Hilary Kramer, editor of GameChangers.

I get it. After years of constant shocks, some investors have decided to let fear drive their decisions. But life on Wall Street is all about day-to-day shocks that add up to a solid long-term outcome.

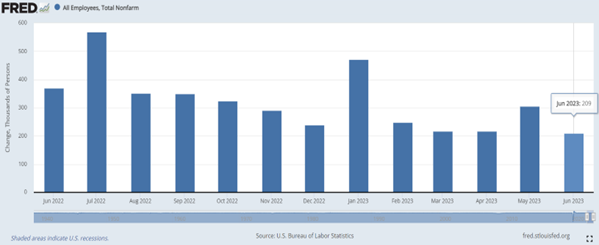

And I have to say the current slate of fear factors is rapidly losing its ability to shock the rest of us. For one thing, news that the economy added 209,000 jobs in June didn’t really change a lot of minds around the next Fed meeting a few weeks from now. If anyone tells you that, take the story with a grain of salt.

And then there’s the recession scenario. Some investors have been out of the market for a year because they’re convinced a serious economic slowdown is lurking just over the horizon. Again, I get it. Staying fully invested in a buy-and-hold strategy isn’t a lot of fun in a recession.

But that recession has yet to be called. As long as the job market remains this strong, the downturn when it finally happens is unlikely to be more than a speed bump...a literal correction after years of running too hot on the Fed’s zero-rate jet fuel.

Furthermore, someone who hit the sidelines a year ago missed out on a 14% end-to-end gain on the S&P 500 in the intervening period. Avoiding the recession that wasn’t might have helped those investors sleep better, but it cost them those gains.

Those are the kinds of gains that stocks like ours are unusually well suited to capture. After all, when the economy is on the verge of overheating, it takes a lot of fire for a company to show up against that background. You need to be growing with explosive speed, rewriting the competitive landscape in the process.

With that kind of force, you can outrun or at least outmaneuver whatever economic roadblocks get in your way. You have less to lose in the disruption that accompanies a deep recession as well...the companies that innovate through the storm tend to end up among the winners of the new expansion cycle beyond.

At least, that’s the pattern that has prevailed in the past. And I think it’s why our stocks in particular will have the right stuff to shake off the last traces of the bear era and rack up shareholder wealth a lot faster than the market as a whole.