AGNC Investment Corp. (AGNC) was just added, locking in a 14.8% dividend yield. The bond market is starting to respond to the notion that the economy will enter a slow-growth phase and not decelerate as the recession camp would have it, writes Bryan Perry, editor of Cash Machine.

If that is correct, most high-yield asset classes should bid higher against this backdrop under the impression that inflation is getting tamed.

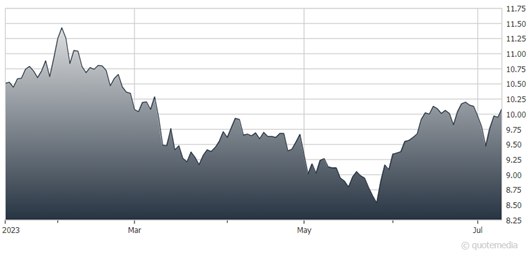

AGNC Investment (AGNC)

Meanwhile, there has been a lot of attention on the June inflation data in the form of Consumer Price Index (CPI) and Producer Price Index (PPI) reports. Come Friday, the second-quarter earnings season also officially gets underway with the release of Q2 results from JP Morgan, BlackRock, Citigroup, State Street, Wells Fargo and United Healthcare.

But the market doesn’t seem to be in the mood for waiting to see what it doesn’t know, as stocks have rallied broadly. Money has rotated out of the leading mega-tech companies and into stocks with higher risk profiles. The idea of missing out on further market gains for the second half of 2023 is taking hold of investor sentiment.

Bottom line? We’re in a wait-and-see period with optimism back on the rise. But there seems to be some fear of missing out (FOMO) sentiment creeping in with the announcement of a few more IPOs, Amazon Prime Day having kicked off, Microsoft winning a key court battle in its pursuit of acquiring Activision, and the feeling that the inflation figures are market-friendly. It just feels like the clouds of recessionary fears are lifting.

Recommended Action: Buy AGNC.