A minority of actively managed stock mutual funds beat the indexes or index funds. That’s well-known. Most people say the difference is due to the higher fees and expenses of actively managed funds. But it’s not the only reason for the performance difference, and it might not be the most important factor. One successful active fund I like is Oakmark Fund (OAKMX), writes Bob Carlson, editor of Retirement Watch.

A key reason for underperformance is the behavior of individual investors. The bulk of investors unintentionally follow a buy-high, sell-low investment strategy.

They pour money into the recent top performers, chasing investments that are making the latest headlines. Unfortunately, that’s usually when such investments are peaking. These investors sell after the prices decline.

Over time, individual investors earned an average annual return over three decades of 6.9%, while the average mutual fund earned 7.7%, according to a study reported in The Wall Street Journal. The difference is due to the buying-and-selling pattern described above.

That bad timing by individuals also reduces the returns of the mutual funds. Fund managers can’t always buy and sell stocks when they want. The funds have to buy stocks when new money flows in and have to sell stocks when investors redeem fund shares. So, the funds have to buy high and sell low, because that is what a portion of their shareholders are doing.

That bad timing by individuals also reduces the returns of the mutual funds. Fund managers can’t always buy and sell stocks when they want. The funds have to buy stocks when new money flows in and have to sell stocks when investors redeem fund shares. So, the funds have to buy high and sell low, because that is what a portion of their shareholders are doing.

Another factor is that almost all the long-term returns in the indexes come from very few stocks, 4.3% of all stocks, according to one study also reported in the WSJ. Less than half of all publicly traded stocks generate positive returns during their existence.

Index funds are designed to hold all the stocks in an index while actively traded funds are paid to narrow their holdings. Missing a small number of the big, long-term winners greatly diminishes a fund’s returns relative to the indexes.

The research shows that mutual funds that hold 100 or more stocks tend to outperform those holding 50 or fewer stocks, though that’s not true for all funds.

Also, an index fund continues to hold its winners, even if they become overvalued or grow to be a significant percentage of the index. Mutual fund investors often become scared and sell shares when active fund managers do that, forcing the fund managers to sell stocks they still like.

Not all actively managed mutual funds trail the indexes over the long term. Those that are competitive with the indexes tend to have a few features in common. The successful funds have lower-than-average expenses. They’ve been successful in the past identifying some of the big winners.

The 10 largest positions in a successful fund tend to account for a high percentage of the entire fund, which matches what happens in index funds. Successful active managers also tend to trade infrequently, as revealed by the funds’ turnover ratios, which also matches what index funds do.

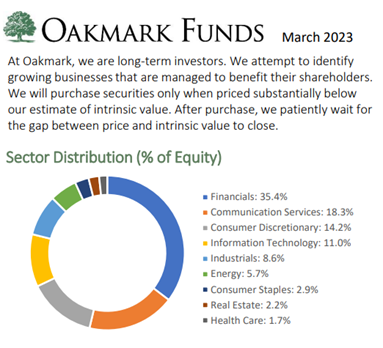

For examples of successful actively managed funds, take a look at two mutual funds in my True Diversification portfolio, OAKMX and WCM Focused International Growth Fund (WCMRX).

Recommended Action: Buy OAKMX.