3M Co. (MMM) has four operating divisions. Its business tends to rise and fall with the broader economy, but its industry dominance has come about due to its focus on innovation, writes Ben Reynolds, editor of Sure Retirement.

The Safety & Industrial division produces tapes, abrasives, adhesives, supply chain management software, personal protective gear, and security products. The Health Care segment supplies medical and surgical products, and drug delivery systems. The Transportation & Electronics division produces fibers and circuits. And the Consumer division sells office supplies, home improvement products, protective materials, and stationery supplies.

In July 2022, the company announced that subsidiary Aearo Technologies had filed for bankruptcy as 3M is facing several lawsuits, including nearly 300,000 claims that its earplugs used by US combat troops were defective. In December 2022, the judge overseeing the case found the company had litigated the case for four years and never indicated that Aearo was to blame until the bankruptcy proceedings.

In June 2023, the Aearo bankruptcy was blocked, and 3M is looking at appeal options, believing that an appeal would significantly change outcomes. On June 22, 3M announced it had entered into an agreement to pay the present value of up to $10.3 billion over 13 years in a settlement with public water suppliers regarding PFAS.

For perspective, the company has averaged free cash flows of ~$5 billion annually for the last decade, dividend payments are currently ~$3.3 billion annually, and the settlement averages to ~$0.8 billion annually for 13 years. The company’s dividend is still covered, and 3M has capacity to raise cash with debt if needed.

On April 24, 3M reported first-quarter earnings results for the period ending in March. Revenue fell 9.7% to $7.7 billion, while adjusted earnings-per-share of $1.97 compared unfavorably to $2.65 in the prior year. Organic growth for the Health Care segment grew 1.4%, while Transportation & Electronics, Consumer, and Safety & Industrial were lower by 11.3%, 6.8%, and 6%, respectively.

The company spends heavily on research and development, typically between 5% and 6% of sales. This investment does not go unrewarded as the company often adds hundreds or thousands of patents each year to its portfolio. It has now surpassed 121,600 in total patents.

But 3M’s earnings-per-share have a compound annual growth rate of 4.6% since 2013. We believe the company could see 5% annual earnings growth through 2028.

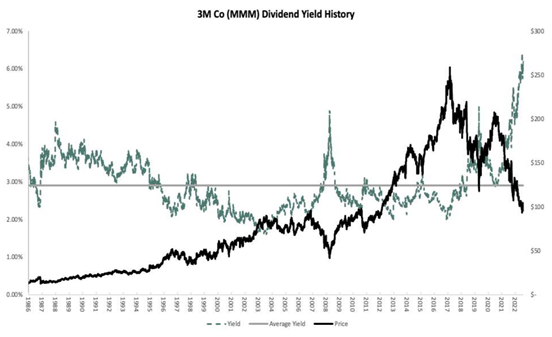

Shares are trading at 11.6 times our expected earnings-per-share of $8.75 for 2023, compared to our target P/E of 17, implying an 8.1% tailwind to annual returns for the period. We forecast annual returns of 17.0% through 2028, stemming from a 5% earnings growth rate, a 5.9% starting yield, and a high single-digit contribution from multiple expansion.

Recommended Action: Buy MMM.