One of the most well-known phrases on Wall Street is “irrational exuberance.” It was coined by former Federal Reserve chair Alan Greenspan in 1996, around the time the now-infamous tech bubble was beginning to form. Twenty-seven years later, irrational exuberance pops up whenever stocks seem to be defying the gravity of bad headlines and questionable economic data, writes Callie Cox, US investment analyst at eToro.

As you could probably guess, it’s being used a lot these days. Rates are at a 22-year high, yet the S&P 500 is also within striking distance of a record high. To many of us, that equation doesn’t add up correctly.

But current Fed chair Jay Powell subtly hinted recently that the optimism might be more rational this time around. You see, for most situations in life, actions matter more than words. But for the Fed, words have mattered more than actions — at least in regards to your portfolio.

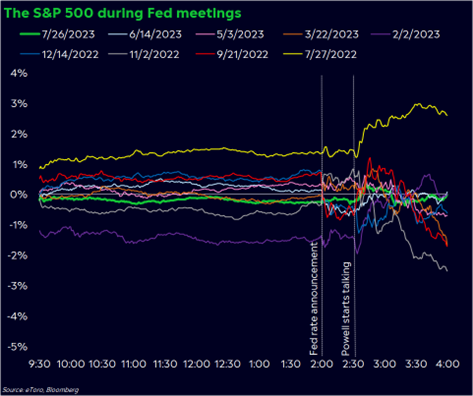

We’ve seen that in many instances over the past year, but mainly in the press conferences after each Fed policy announcement. Powell has delivered a lot of tough love — and catchphrases — during these events. Lately, he’s reminded us of how committed the Fed is to getting inflation back down to 2%, even if that means rising unemployment and a potential recession.

Until last week. When Powell took the mic, he made three important statements:

Fed staff are no longer expecting a recession.

The Fed is ready to act if a recession strikes.

Rate cuts could come as soon as next year.

Put it all together, and I think Powell is sending a subtle message through his words: The economy can make it through this rough patch. And if not, we’re here to help.

Powell’s words should make you think long and hard about the risk of higher prices — and if you’re stuck in a case of “irrational pessimism”.

A lot of people just don’t believe we’re in a bull market. In fact, 86% of US investors are in that camp, according to the US segment of our June Retail Investor Beat survey. I’ve heard firsthand from people who are waiting for an even bigger drop before buying back in. And while that could happen, it might be smart to start considering a world where it doesn’t. Especially if the Fed is right, and a recession may not be coming.

The past few years have taught us all valuable lessons. One I keep coming back to is how long-term views only work if you can survive short-term moves.

There are plenty of reasons not to invest in this market. But there’s also a risk in sitting out of the market, and the Fed may have just ruled out your chance at lower prices.