Our rating on Fiserv (FI) is “Buy” with a target price of $150 (raised from $140). We believe that Fiserv, a financial services firm, benefits from a highly scalable business model. Over the last several years, it has consistently turned single-digit revenue growth into double-digit EPS growth with help from strong margins and share buybacks, notes Stephen Biggar, analyst at Argus Research.

Management currently projects EPS growth of 14%-16% in 2023. Fiserv should also benefit from strong technology spending by its bank and credit customers. These customers often focus their spending on areas that are central to Fiserv’s value proposition, which includes increasing the efficiency of mobile payments processing.

Innovation in this area has been a strong point for Fiserv, with products such as Mobiliti for mobile banking; DNA for account processing; Zelle, a peer-to-peer payment solution; and, more recently, CheckFree Next for bill payments. With the acquisition of First Data, Fiserv’s portfolio also includes Clover, a cloudbased point-of-sale platform similar to Square.

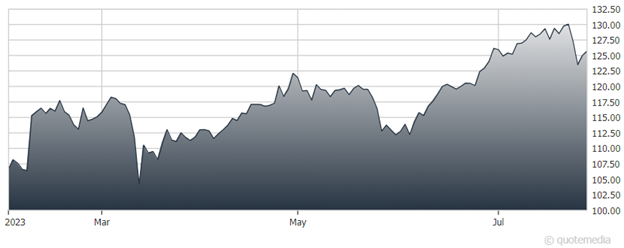

Fiserv (FI)

Compared to a group of peers (SQ, FIS, GPN, AFRM, among others), Fiserv shares are trading at discount valuations; however, we believe that they merit higher multiples given the company’s consistent double-digit EPS growth, operating margin expansion, record of product innovation, and scalable business model.

The company began trading on the NYSE on June 7 under the ticker “FI.” Over the past year, FI shares are up 33%, versus a 15% increase for the broad market. On July 26, Fiserv reported 2Q23 adjusted EPS of $1.81, up from $1.56 a year earlier and above the consensus of $1.79. Adjusted revenue was up 6% to $4.51 billion. The adjusted operating margin rose to 36.5% from 33.5%.

Fiserv raised its full-year outlook. For 2023, management now projects adjusted EPS of $7.40-$7.50, up from a prior $7.30-$7.40, representing 14%-16% growth, and organic revenue growth of 9%-11%, up from a prior 8%-9%. In December 2022, the company acquired Merchant One, an independent sales organization focused on acquiring merchants in the restaurant, retail, and e-commerce industries.

Recommended Action: Buy FI