Last week, the average price of a gallon of gas climbed to $3.83, the highest in 10 months. I swung by the gas station on Tuesday and paid $50 to fill up my tank. That hasn’t happened to me in a while, and it’s one example of how inflation is moving in the wrong direction, explains Callie Cox, US investment analyst at eToro.

The past few months of soft-landing talk has felt good for our confidence and our portfolios. Now, with higher gas bills and soaring interest rates, it seems too good. Signs of faster inflation — a natural byproduct of good times — are popping up again.

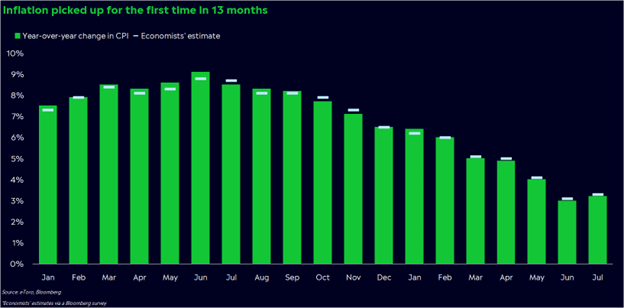

Last Thursday, CPI data showed prices grew 3.2% year-over-year in July, a faster pace than the 3% increase in June. It was the first time that inflation picked up in nearly 13 months.

Much of the sudden increase in inflation was from higher gas prices — that annoying trend you’ve probably noticed already at the pump.

This may not be a one-month blip, either. Americans’ inflation expectations have started rising again, and the Cleveland Fed forecasts that year-over-year CPI probably increased this month as well.

Sure, we may have avoided the dreaded recession. But in some ways, it feels like we’re back to square one — spiraling inflation that the Fed needs to hammer down through higher rates. If you’re worried about another inflation crisis, your feelings are valid.

But I want to make one thing crystal clear: We are probably not in the same situation as 2022. Far from it, actually.

So, what does this mean for me?

Don’t panic. This may feel like deja vu, but it’s a different situation than we were in just a year ago. Remember that bull markets usually end with recessions or market crises — both of which don’t look likely at the moment.

Consider the good news. The tide in market leadership has turned, with cyclical — or economically sensitive stocks — driving the rally. Good news about the economy could be seen as bad news, at least for now. But it’s good news if you’re worried about a recession.

Think about the opportunity. Energy prices are driving inflation higher. Sure, higher gas prices are a pain, but they could be a boon for energy stocks — one of the cheapest sectors in the market on a price-earnings basis. Think about how to protect your portfolio if higher inflation causes a panic in stock and crypto prices, but remember there are usually two sides to every trade.