The mood has not cratered. The bear is not back. The bull is not dead. That is why I’ve remained so upbeat throughout this earnings season, including on one of my favorite stocks, The Trade Desk (TTD), elucidates Hilary Kramer, editor of GameChangers.

Nobody who said they were comfortable with a $454 million revenue target has any reason to be disappointed with the $464 million TTD reported, especially when it translated into an extra $0.02 per share in profit that Wall Street was collectively not expecting.

Some people wanted a little more, but most thought we were going to get a lot less. The overall impact should have triggered more net buying than selling. Maybe they’re already discounting these numbers and looking toward a colder future? No.

TTD management is pretty confident that revenue in the current quarter will hit at least $485 million, up 4% sequentially. The numbers are getting better month by month and season by season. Do all the math and earnings per share are probably also tracking $0.02 better than consensus.

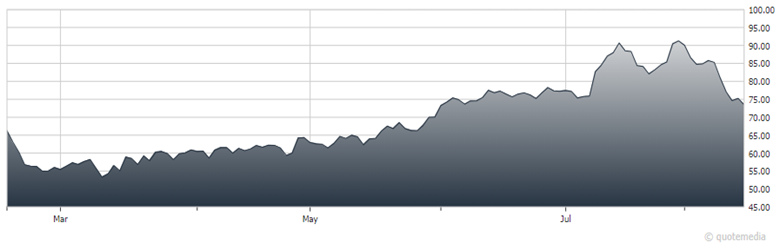

The Trade Desk (TTD)

This was a classic beat and a raise. The company did better last quarter than Wall Street anticipated. It’s doing better in the current quarter as well. TTD is now on track to earn at least $1.28 per share in the current year, which implies a growth rate of 20-25% on the bottom line.

Granted, that growth has earned a high valuation. Not too long ago, TTD was selling at an impressive 68X current earnings...3.5 times the multiple of the S&P 500. But the S&P 500 is in an earnings recession. TTD just proved that it can boost the bottom line at least 20% this year.

That’s worth a premium price. And here’s the thing: TTD hit $76 a year ago, when it was a 20% smaller company and Wall Street found the strength to pay 73X current earnings for it then. Higher valuation then. Significantly lower valuation now.

Meanwhile, in the past year, the S&P 500 has managed to shift its multiple from 16.7X to 19.5X current earnings. The market as a whole has gotten more expensive. TTD has gotten cheaper. The only thing holding it back is fear itself.

Recommended Action: Buy TTD