Southwest Airlines (LUV) is not on my Top 10 stock list this month, but the company does have a policy that is applicable to the Sure Passive Income Newsletter. I’m going to explain what it is today, writes Ben Reynolds, editor of Sure Passive Income.

When you are booking a flight, you might wait to try to get the best price. However, Southwest does not charge change or cancellation fees. So, if the flight price declines, you can rebook and get the difference back.

As such, the best strategy is to simply purchase the flight now and then see what happens. If the fare goes higher, you’re glad that you already booked it. If it goes lower, you can do something about it.

Investing in “buy and hold forever securities” can be treated in a similar manner. The Sure Passive Income Newsletter does not place a great deal of emphasis on expected return. Instead, it focuses on quality companies, growth, and dividend yield. The concept is to generate a list of securities that can be purchased today and held for the long-term, without worrying about day-to-day share price fluctuations.

One pick this month is Illinois Tool Works (ITW), a diversified multi-industrial manufacturer with seven unique operating segments, including: Automotive, Food Equipment, Test & Measurement, Welding, Polymers & Fluids, Construction Products, and Specialty Products.

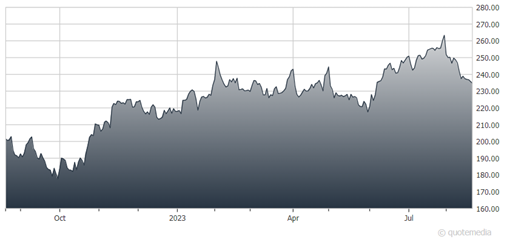

Illinois Tool Works (ITW)

The company generated revenue of nearly $16 billion last year and is valued at $72 billion. On August 1, ITW reported second-quarter 2023 results for the period ending June 30. For the quarter, revenue came in at $4.1 billion, up 2% year-over-year.

Sales were up 16.2% in the Automotive OEM segment, the largest of the company’s seven segments. Food Equipment, Welding, and the Test & Measurement and Electronics segments grew revenue by 6.3%, 0.7% and 0.7%, respectively. Meanwhile, Polymers & Fluids, Construction Products, and Specialty Products saw revenue decline by 7.6%, 6.8% and 5.4%.

Net income equaled $754 million, or $2.48 per share, compared to $738 million, or $2.37 per share, in Q2 2022. ITW raised its 2023 guidance and sees full-year GAAP EPS to be between $9.55 and $9.95 (up from $9.45 and $9.85 previously). Additionally, the company expects to repurchase roughly $1.5 billion of its own shares during the year. We forecast $9.75 in earnings-per-share for this year.

Despite operating in a cyclical sector, Illinois Tool Works has a very impressive dividend growth streak of 60 years. This qualifies the company as both a Dividend King and a Dividend Aristocrat. The dividend has a compound annual growth rate of 13.6% over the last decade, though that has slowed slightly in the near-term.

The projected payout ratio for 2023 is a reasonable 57%, making it likely that ITW will be able to continue providing investors with annual increases for years to come. The balance sheet is in good shape, with less than $8 billion of long-term debt. Therefore, ITW should have flexibility from a capital allocation standpoint.

Recommended Action: Buy ITW