The reason we invest boils down to two motives: Building wealth for the future and generating income right now. Dividend stocks are the way to reach both goals! The trick is to invest for tomorrow and today at every stage of your life, writes Kelly Green, editor of Dividend Digest.

You put money away for future events like retirement, your children’s college fund, home renovations, or that dream vacation. Just as important is boosting your income today for things like raising your standard of living, paying for life’s unexpected expenses, or planning a career transition.

We’ve all seen the clickbait headlines that declare, “The Only Dividend Stock You’ll Ever Need.” Don’t fall for it. Dividend investing is not a one-click decision. There are several types of dividend stocks, and you need to know their differences to achieve your goals.

My dual-track system makes dividend investing simple and straightforward. Dividend stocks should be split into two groups: Bedrock stocks and Current Yield stocks. This lets you identify the best stocks to use for each goal.

Bedrock stocks are the companies that work best for long-term wealth building. These stocks have a proven dividend history and, in most cases, a track record of increasing their dividend. This group can also include high-quality, exchange-traded debt and preferred shares.

To make this money work to its full potential, we reinvest the dividends to add the power of compounding. It’s a way to add leverage without adding risk. Compounding can unlock exponential growth from your money.

Current Yield stocks are companies that pay solid income. You might only hold these shares for one year. Others could turn into Bedrock stocks that you own for decades. What they usually have in common is higher yields, putting more money in your pocket right now.

I look for companies with a compelling story or catalyst that supports the current yield. I also uncover gems among the ranks of REITs, BDCs, and MLPs that are known for their generous yields. There are many Current Yield stocks that pay 5% to 10% yields.

Armed with this two-basket dividend strategy, it comes down to applying it to your individual situation.

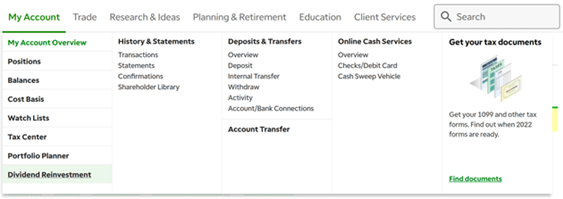

If you’re in a wealth-building stage of life, the majority of your portfolio should be in Bedrock stocks with dividends reinvested. Most online brokerage accounts make doing this super simple. Just look for the Dividend Reinvestment or DRIP option in one of the drop-down menus.

Source: TDAmeritrade

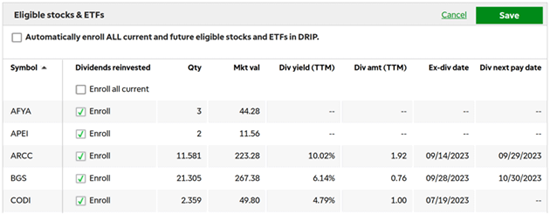

If you’re looking for income generation, make sure you choose to have dividends paid rather than reinvested. This selection is easily made in many online brokerage accounts using a checkbox option next to all your stock holdings.

Source: TDAmeritrade

The beauty of this strategy is it can change to meet life’s changing priorities. You can adjust how much money is earmarked for wealth building, and how much puts extra income in your pocket. It’s a total winner and a great way to maximize the growth of your money.

This two-basket dividend system can be your roadmap to money success at every stage of life. All you have to do is identify your goals and time horizon. Then you can get your money moving you in the right direction. There are many stocks on the market today that fit into each basket.