Will the 2020s be more like another “Roaring 1920s” or the stagflationary 1970s? Like economist Ed Yardeni, I’d bet 2-to-1 for the ‘20s scenario, but nothing is certain. It depends on our national choices. It’s not too late to chart the fate of this decade’s course, writes Gary Alexander, senior editor of Navellier & Co.

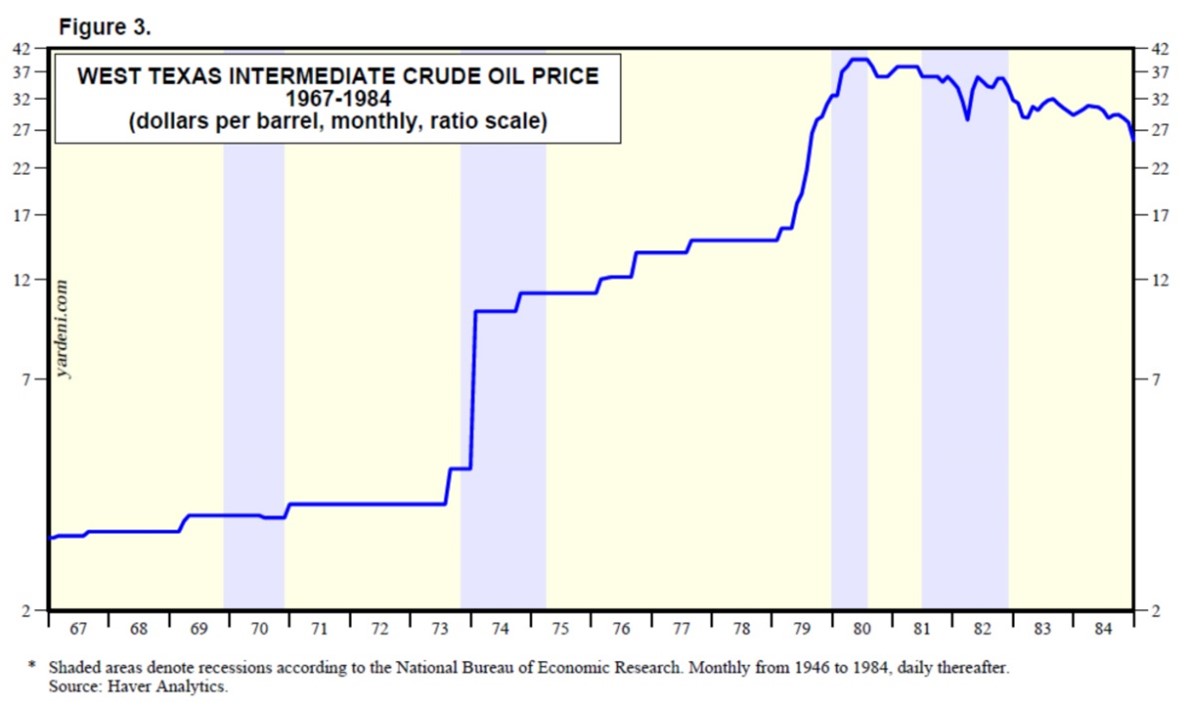

The 1920s and 1970s didn’t start in Year 0. They only began to come into clear focus about now – late in Year 3. For instance, the main engine for inflation in the 1970s came after the OPEC oil embargo in October 1973 (see chart below), and the main engine of the Roaring 20s came when Cal Coolidge took over from aging Warren Harding in August 1923.

Graphs are for illustrative and discussion purposes only.

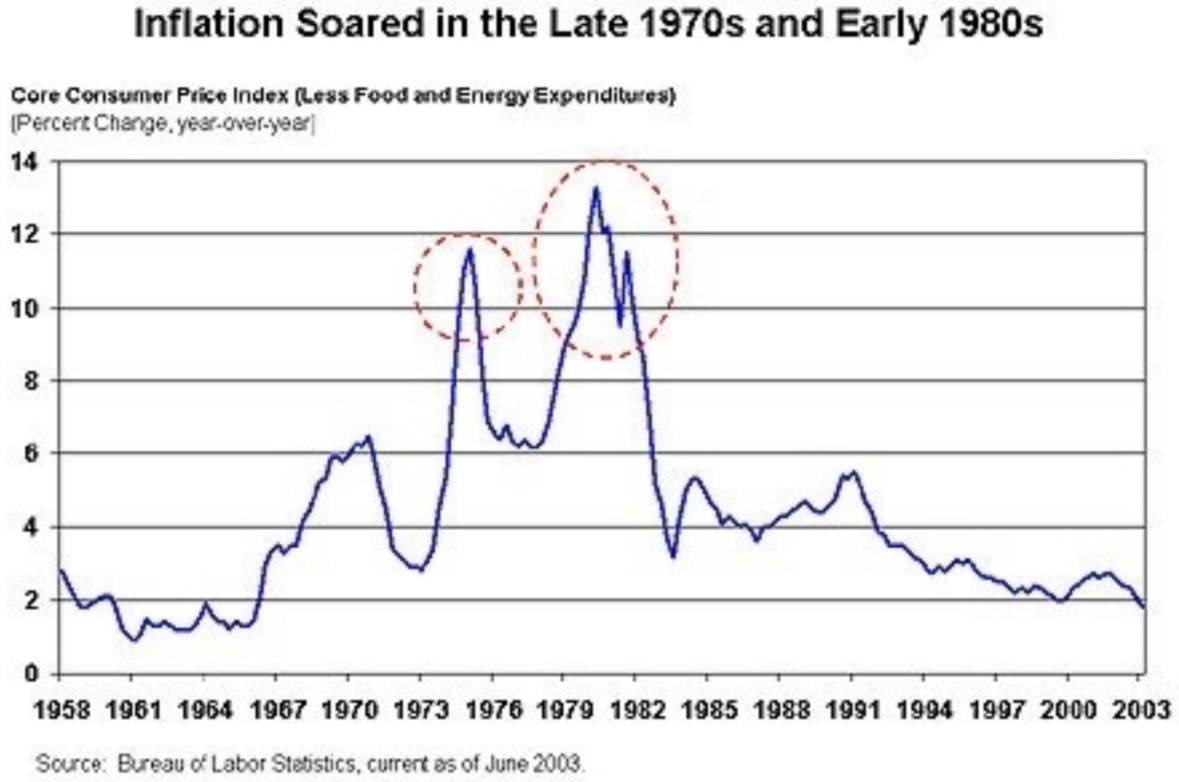

As seen in the first sharp vertical line above, the chronic high inflation of the 1970s began with the OPEC oil embargo following the Yom Kippur War in October 1973. This also launched the 1973-74 recession and a deep market crash. Inflation stayed above 6% per year and averaged double digits for a decade.

Graphs are for illustrative and discussion purposes only.

Likewise, the “Roaring 20s” never started to roar until the middle of the decade. There was a deep stock market crash in 1920-21 and slow growth at first, but GDP growth and stock market gains finally began in earnest after Calvin Coolidge inherited the Presidency a century ago in August 1923, when Congress and Treasury Secretary Andrew Mellon joined Silent Cal to lower tax rates and promote business growth.

So again, will we soon enter another Roaring 20s, or Stagnant 70s? Energy inflation is rising again, so maybe today feels more like the 1970s. But there is still a strong case for the Roaring 20s, too.

Ed Yardeni is a chronic optimist, as am I. But I would bet that most of today’s pundits would flip his odds and offer 2-1 money favoring a decade of stagnation and inflation for the remainder of the 2020s, with only perhaps a 30% chance of seeing a new type of Roaring 2020s.

After all, they would argue, prices at the pump are soaring once again. The UAW may go on strike for a pay increase of up to 47% in the next four years. The federal deficit is expanding out of control, perhaps reaching $2 trillion this year or next. The high and unexpected costs of green energy are crippling the economy and debt service. Onshoring isn’t working much better than our “Made in China” addiction, and good workers are still hard to find.

Taken together, that’s a mighty steep wailing wall of worry. But bear in mind that there is an election coming in just over 14 months, and some sort of emerging majority may wake up enough to want fewer regulations, more energy diversity, honest money, less government, no new wars, economic growth, and conservation by invention rather than punishing growth and hand-cuffing our greatest innovators.

I stress that principled people come from either major party, or among Independents. It just takes guts. The outcome rests within each investor, business owner, worker, and voter. What is our vision? To Roar with purpose, or to elect over-spending, over-promising, unprincipled leaders recycled from the 1970s?