At least Jay Powell finally had his say and now we can get back to work. When our earnings cycle started on July 27, long-term bonds paid 4.01%. They have since suffered shock after shock, pushing that widely watched yield all the way to 4.34% last week. But Roku (ROKU) is shaping up nicely regardless, notes Hilary Kramer, editor of GameChangers.

The higher rates go, the louder the noise gets in our end of the market. That’s obviously been a source of frustration. But the season started with a big bullish bang and ROKU has held onto more than 13% of that initial post-earnings surge. This is how it works when the noise fades into the background and the fundamentals shine through.

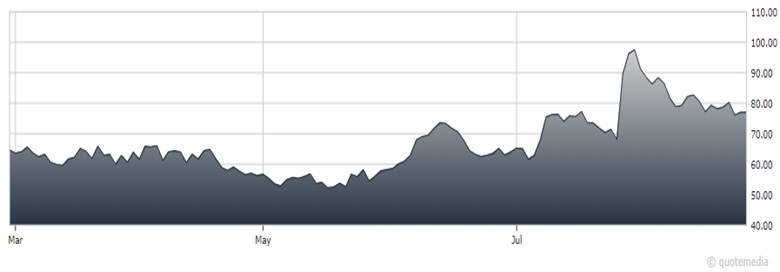

Roku (ROKU)

The recent selloff in stocks is far from the end of the world. It isn’t even a full-fledged correction. And I have to say that if that’s the worst Jay Powell and the bond market can do to these stocks, any distress we’re feeling will be temporary.

Distress is always temporary as long as you focus on stocks that are growing their underlying business faster than the market as a whole. Sooner or later, they’ll grow into valuations that might look stretched today. That’s not in doubt. The only “x” factor in that proposition is whether that “sooner or later” comes fast enough to pay off before shareholders run out of patience.

When your stocks can demonstrate growth, that’s a strong buy signal because those companies will generate more cash in the future and be worth more than they are today. Everything that interferes with that signal is noise. Louder noise interferes with the signal more intensely and for longer periods of time.

And the thing about noise is that it’s transitory. It ebbs and flows. Jay Powell gets a few chances every year to talk the market up or down. Bond yields ultimately stabilize, and investor expectations recalibrate. But the signal keeps flashing until the earnings trend changes. Guidance from all our companies was confident: the trend isn’t changing in the current quarter.

As for ROKU, remember that this was a $130 stock before the pandemic. So, we aren’t asking for miracles like a run back to the lofty $490 ROKU enjoyed in the bubble era. All we want is justice for a company that’s come a long way in the last few years.

Recommended Action: Buy ROKU.