The Fed’s tight money policy is finally having its dampening effect on price inflation, stocks, and commodities. The US economy and Wall Street have resisted the Fed’s tight-money policy, but they are finally succumbing to the reality of sharply higher interest rates. The action in Main Street Capital (MAIN), the Houston-based private investment firm, shows the impact that is having, explains Mark Skousen, editor of Forecasts & Strategies.

It didn’t help to see Fitch, a rating service, downgrade US Treasuries to AA due to the excessive deficit spending by the Biden administration. Long-term rates are substantially higher than short-term rates (T-bills are yielding 5.3%). Historically an inverted yield curve spells trouble — the possibility of a recession is rising.

Consumer spending is still robust, rising over 6% during the past two quarters, but business spending (B2B) is down 9%. Many of our stocks and mutual funds are in a correction mode right now, but one bull market is still intact in commodities: Uranium.

Meanwhile, the yield on the benchmark 10-year Treasury Note just topped 4.25%, the highest it has been in 15 years. And the 30-year mortgage rate is now over 7%. Even our Schwab Value Advantage Money Fund (SWVXX) is now paying 5.2%.

This spells trouble in the stock market, which now must compete with bonds and money market funds. Stocks may continue to struggle as we enter September, a notoriously volatile month.

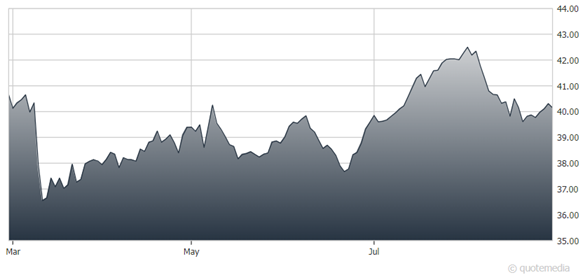

Main Street Capital (MAIN)

Take MAIN. Last month, it reported quarterly earnings of $1.06 per share, 41% higher than its year-ago earnings of 75 cents for the same quarter.

It also paid its second 23-cents-per-share monthly dividend. MAIN has already paid $1.98 per share in dividends this year. Its total return is 16% year to date. Zacks Research gives it a strong buy. And yet, the stock’s price is down in August. I see it as a buying opportunity.

Recommended Action: Buy MAIN