Summer is ending, and you know what that means: It’s time to go back to school. Investing is largely mental, after all. Markets are constantly changing, and your ability to process and adapt to change can make or break your portfolio. Don’t get intimidated, though. You can easily prep your brain with a little time and intention, writes Callie Cox, US investment analyst at eToro.

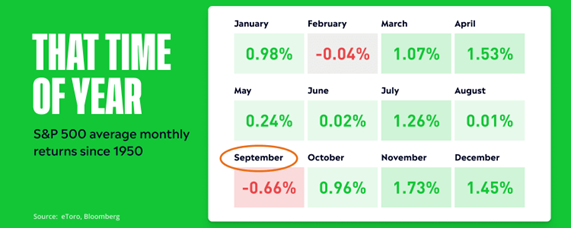

Right now, there seems to be a lot of pressure on your portfolio. Volumes are picking back up, and the economic outlook feels murkier than ever. You may have to fight some fall-itility, too. September has been (on average) the S&P 500’s worst month of the year since 1950, and October has been the stock market’s most turbulent month over that same period.

If you’re feeling overwhelmed, you’re not alone. No matter if you’re a long-term investor or a short-term trader, you may have to weather some tough storms over the next few months.

But don’t forget that timeframes matter a lot in investing, and there are significant benefits to starting early and investing for years (mainly, the power of compounding returns over long periods of time). We often forget that long-term views are just a series of short-term views. And small steps can add up over time.

Right now, people are terrified that we could find our way back into a bear market again. Just look at survey data. Investors’ moods soured for most of August as stock prices slid, according to the American Association of Individual Investors’ weekly survey, even though the S&P’s 4.6% selloff was fairly tame by historical standards. And in August, the Conference Board’s confidence index deteriorated at the fastest pace in two years.

But when stocks slide, try cognitive reframing. Sure, your investments may be dropping, but wise investors view pullbacks as stocks on sale instead of times to panic. Why? Because markets go up and down. It’s the natural rhythm of investing. That’s why the S&P 500 has clocked 8% average annual returns since 1950, even after enduring 32 bear markets and corrections.

Class, I’ve saved the most important lesson for last.

If you’ve felt unmoored by the ups, downs, and uncertainties of markets, it might be time for an honesty hour. Ask yourself why you’re investing, and don’t be afraid to tap into your hopes and dreams. There’s no wrong answer.

Take it seriously, though. Your “why” is crucially important. All of your investing decisions should flow from your why — from what you’re investing in to how long you should hold each stock and when you’re ready to sell. And if you’re investing just to make money, keep in mind that focusing on turning a profit or beating the market can tie your emotions to your day-to-day returns. Remember, nobody has a crystal ball, so they can’t predict what the future holds.