Wall Street faces a conundrum: An aggressive fiscal policy with growing trillion-dollar deficits by Congress in the face of a tight monetary policy by the Federal Reserve. The result has been both stubborn inflationary pressures and the threat of a recession. But our commodity stocks are all showing strength, including uranium producer Energy Fuels Inc. (UUUU), notes Mark Skousen, editor of Forecasts & Strategies.

Interest rates are rising again across the board, and now vary from 5.3% in the short term to nearly 8% for 30-year mortgages. The Federal Reserve seems determined to fight inflation even to the point of creating an economic contraction and maybe another banking crisis.

Many of our stocks and mutual funds are in correction mode right now. But our commodity positions are doing well.

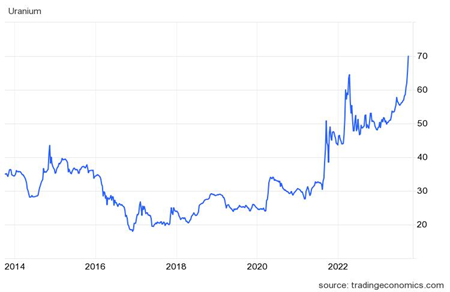

Our decision to buy uranium was particularly well timed. Last month, uranium shot through $60 a pound, and is now at $65, a 12-year high. Uranium has recovered from the Fukushima disaster in Japan, which drove the global uranium industry into limbo and caused Germany to abandon its nuclear power program.

But things are changing. More nations are turning to nuclear power as an alternative to fossil fuels and especially green energy sources like wind, water and solar, which are much less efficient and have to be subsidized.

An unprecedented number of nuclear power plant restarts and new constructions have been announced, and that is likely to boost demand, even as supplies of uranium have fallen short. Our uranium producer UUUU is now ahead 20% since we first recommended it. No doubt there will be corrections on the way, but the long-term trend is still up.

Energy Fuels will benefit from higher prices. Last year, revenues rose 6% to $26 million. It has $100 million in cash and only $1.3 million in long-term debt. According to Zacks Research, UUUU’s revenues will rise to $44 million this year, and earnings will climb to 63 cents per share — more than triple what they were last year.

Recommended Action: Buy UUUU.