We are maintaining our “Buy” rating on DraftKings (DKNG) with a target price of $34. Reflecting the legalization of online sports betting in additional states, we expect DKNG's revenue to jump to $3.2 billion in 2023 from $2.2 billion in 2022. Tailwinds include market share gains and greater customer retention, notes John Staszak, analyst at Argus Research.

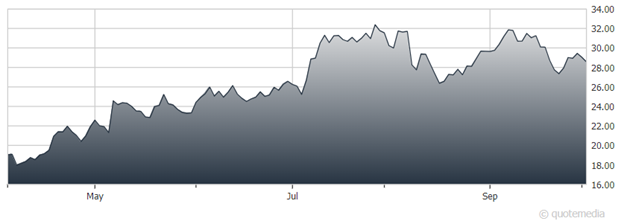

DKNG shares have risen 46% since our upgrade to buy on March 6. Driven by geographic expansion and prospects for a strong fourth quarter, we think that the shares can move higher. As discussed in a previous note, on August 9, DKNG shares fell after Penn Entertainment (PENN) announced that it will spend $2 billion to acquire the media, marketing, and brand rights to ESPN. PENN also purchased the right to use the ESPN Bet trademark for the next 10 years.

We think that the share price weakness represents a buying opportunity. While DKNG had a sponsorship agreement with ESPN, we believe that the agreement has had a negative impact on earnings. We think that the acquisition could be a plus for DKNG because PENN is likely to end ESPN’s agreement with DraftKings.

DraftKings (DKNG)

DraftKings reported 2Q23 results on August 4. The company posted adjusted earnings of $0.14 per share, compared to a loss of $0.50 per share in the prior-year period. Earnings surpassed the consensus loss forecast of $0.12 per share.

Revenue rose 84% to $875 million, as Monthly Unique Payers (MUP) rose 44%. The consensus had called for revenue of $760 million. Adjusted EBITDA totaled $73 million, up from a loss of $118.0 million a year earlier. The consensus estimate had called for adjusted EBITDA of $18.6 million.

In 2023, DKNG now expects revenue of $3.46-$3.54 billion, up from a prior $3.135-$3.235 billion. It also projects adjusted EBITDA of negative $190-$220 million, versus a prior loss estimate of $290-$340 million. This guidance assumes that the professional sports calendar remains unchanged and that DraftKings continues to operate in the states in which it currently does business.

Currently, states accounting for 36% of the US population have legalized gambling, while states accounting for 24% of the population allow online gambling. The company has a growth-by-acquisition strategy.

Recommended Action: Buy DKNG.