One of the biggest arguments in the bond markets is how much new supply has contributed to the spike in yields. The persistence of rate hikes, sticky inflation, and a whopping deficit are also important factors. That suggests a confluence of factors have been behind the acute weakness in the sector, writes Eoin Treacy, editor of Fuller Treacy Money.

The biggest change over the coming quarter is the fiscal impulse is receding. The big push from the Inflation Reduction Act is complete and student loan repayments are starting again.

As the Treasury approaches its goal of rebuilding its cash position, the supply of new debt should moderate. Then the question of how large the deficit is, and how the impending debt negotiations go, will influence the direction of the cash balance total.

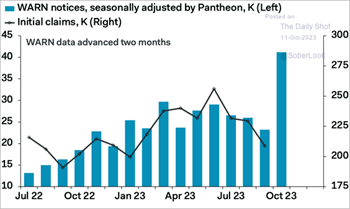

An impending issue which should be bullish for bonds is the spike in WARN Notices over the last month. That is a forewarning of a surge in job losses over the coming month because companies with more than 100 employees have to give notice before they begin firing.

Meanwhile, Fed speak is “higher for longer.” In practical terms, that means “higher for as long as is practical.” Wall Street earnings estimates for next year are wildly bullish against a background where monetary conditions are tightening, and unemployment is likely to rise. The claims that the CAPE P/E is close to average are heavily dependent on earnings improving from here.

There is a loose correlation between the Treasury’s efforts to rebuild its cash balance and weakness in the stock market. It was particularly strong in early 2022 and the rebound began when the balance rolled over. On this occasion, the balance rebuild has been less of a bearish factor for the stock market. But when the Treasury balance rolls over, it may act as a tailwind for a recovery.