Stanley Black & Decker (SWK) can trace its history back to 1843. It is a world leader in power tools, hand tools, and related items, with the top global position in tools and storage sales and second position in the area of engineered fastening, shares Ben Reynolds, editor of Sure Retirement.

On July 28, SWK announced a 1.3% quarterly dividend increase. This extended the company’s dividend growth streak to 56 consecutive years, making it a Dividend King.

On Aug. 1, SWK also announced second-quarter results for the period ending June 30. For the quarter, revenue fell 5.3% to $4.2 billion, but this was $70 million more than expected. Adjusted earnings-per-share of -$0.11 compared very unfavorably to $1.77 in the prior year but was $0.25 above expectations. Companywide organic growth fell 4%.

Stanley Black & Decker provided revised guidance for 2023 as well. The company expects adjusted earnings-per-share in a range of $0.70 to $1.30, compared to $0.00 to $2.00 previously. However, we continue to believe that the company has earnings power of $8.38 per share.

What differentiates SWK from the competition is that the company has a wide variety of well-known and trusted brands, including its namesakes Stanley and Black & Decker, as well as Craftsman and DeWalt. This brand trust is why the company can raise prices without seeing a decline in demand.

Stanley Black & Decker also has a very consistent track record, having grown earnings-per-share at more than 10% over both the last five- and ten-year periods of time. This is the result of having top brands and making key strategic acquisitions.

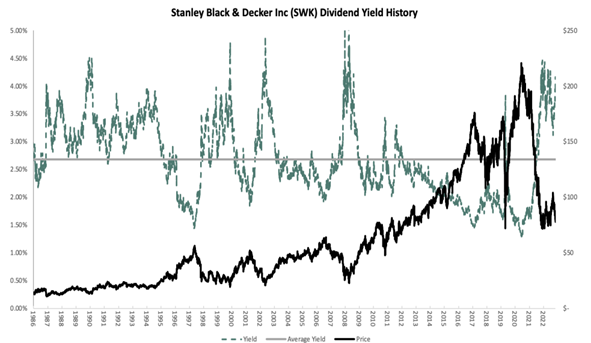

Shares recently yielded 4.1%. The stock has a price-to-earnings ratio (P/E) of 9.4 using our adjusted earnings power figure of $8.38 per share. We have a P/E target of 12.0.

Reverting to our target by 2028 would result in a 5.2% annual gain from the valuation. Total returns through 2028 are expected to be 16.1%, stemming from an 8% earnings growth rate, a starting yield of 4.1%, and a mid-single-digit valuation tailwind.

Recommended Action: Buy SWK.