Walgreens Boots Alliance (WBA) leads this month’s “Top 10” list off with some eye-popping numbers: A 24.2% expected total return and a 9.2% starting dividend yield. You don’t usually see those types of figures for an established company with a 47-year history of increasing its dividend and an expected payout ratio under 50%, highlights Ben Reynolds, editor of Sure Dividend.

This has come about for one basic reason: Earnings expectations are down, but the share price has fallen by an even greater degree. The share price is down 35% in the last year and has been more than cut in half over the last two years.

No one knows the future, so it could turn out that these declines are warranted. There are certainly concerns about the business. However, we do know the past.

From June of 1994 to September of 1994 the share price of Walgreens was also cut in half. During that time Walgreens was in the midst of increasing its dividend for “just” 18 years, and certainly there were concerns about the business back then – there are always concerns. However, that proved to be an opportune time to invest.

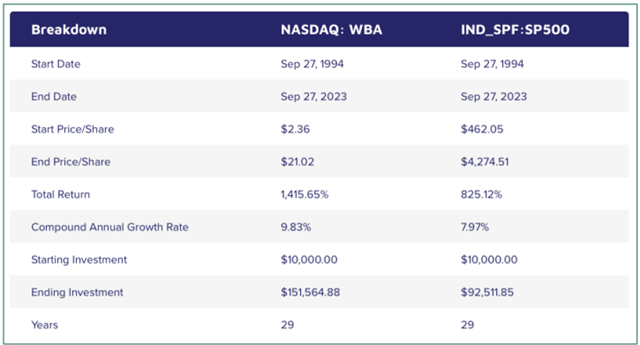

Here’s a look at Walgreens’ performance compared to the S&P 500 since then: A $10,000 starting investment would now be worth $151,000 in Walgreens, compared to $92,000 in the S&P 500 – and remember, this is even after the significant price decline in the last few years.

This doesn’t mean that it will work out this time. But if you’re investing, you ought to think in terms of years or decades, not weeks or months.

Our job is not to bat 100%. If that was the mandate, we would never put out a Top 10 list. Instead, it’s about bringing interesting opportunities to your attention; and Walgreens certainly fits that criterion.

Recommended Action: Buy WBA.