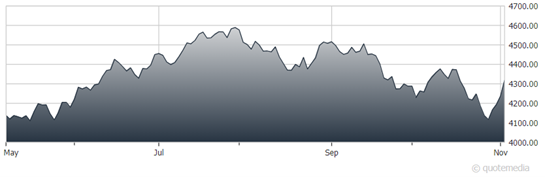

Things now appear to be going “right” for stock and bond investors. The S&P 500 hit a recent low on Friday, Oct. 27, as the weakest six-month period of the year was coming to a close. After the new week got underway, however, investors piled back into equities, explains Sam Stovall, chief investment strategist at CFRA Research.

The catalyst: Expectations for higher rates continued to unwind ahead of the Nov. 1 end to the FOMC meeting and after Fed Chair Powell’s post-meeting press conference hinted that the rate-tightening cycle may have ended.

The tumble in the yield on the 10-year note then picked up speed, after peaking just shy of 5% earlier in October. Add to this the tentative end of the UAW strike and Q3 earnings that now point to a 1.8% gain versus an earlier forecast for a 1.5% decline.

S&P 500 (SPX)

Not surprisingly, expectations for an end-of-year rally have increased. Investors are again reminded that the S&P 500 rose in price an average of 13% in the nine months after the last rate hike in the past 30+ years and the fourth quarter of pre-election years for first-term presidents since 1948 saw the S&P 500 higher 100% of the time.

As a result of this renewed optimism, the S&P Composite 1,500 surged 4.8% week to date (WTD) through Nov. 2, accompanied by gains for all of its component sizes, styles, and sectors. The move was led by 5%-plus gains for the consumer discretionary, financials, real estate, and tech sectors, while the defensive consumer staples, energy, and health care groups lagged.

In addition, 97% of the 153 sub-industries rose in price, with six groups posting double-digit advances, while five groups remained mired in red ink. Moderating employment data and inflation reports should allow the market to maintain its upward trajectory.