As expected, Altius Minerals (ATUSF) reported earnings lower than last year and lower than analyst expectations. But with very strong, contrarian management, a solid diversified base of assets, and multiple upcoming catalysts, Altius, very close to its annual low, is a strong buy here, argues Adrian Day, editor of Global Analyst.

This year’s earnings were always going to be lower than last year, as repeatedly telegraphed by the company, due to lower potash prices after the 2022 spike following the invasion of Ukraine, and by the closure of the 777 copper mine.

Although CEO Brian Dalton said that revenues came in “pretty much as expected”, they were below the analyst consensus. G&A per ounce was higher than last year because of lower revenue, while amortization was also higher.

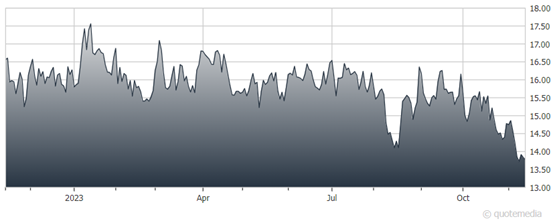

Altius Minerals (ATUSF)

Royalty revenue had been pre-released so there were no major surprises. Altius repaid $2 million on its debt, as scheduled, leaving $115 million in debt. Altius has $16 million in cash (excluding the $51 million at Altius Renewables –– ARR –– which is consolidated on the balance sheet).

It holds about $159 million in ARR; $120 million in shares of Labrador Iron Ore; $50 million in Lithium Royalty shares; and $45 million in publicly traded shares in the Project Generation equity portfolio.

Although the debt is perhaps higher than it has been historically, its equity positions support the balance sheet, and Altius wants to take the opportunity now to buy back its shares which it sees as the best allocation of its capital. During the quarter, it bought back nearly $6 million in shares.

Looking ahead, there are several potential catalysts. Champion Iron is working towards completion of an updated feasibility study for the Kami project, expected by year end or early next; Altius has a royalty on the project.

AngloGold (AU) expects to publish an initial inferred resource estimate for Merlin and a pre-feasibility study for the Expanded Silicon Project by year-end. Arbitration on the extent of Altius’ royalty is expected in April 2024.

And an appeal was heard recently on Altius’ takings lawsuit against Alberta over the forced stoppage of the coal mines on which Altius held royalties. Revenue from that source is expected to fully end by year-end.

Recommended Action: Buy ATUSF.