I recently gave the opening lecture at Hillsdale College on “The Genius of Adam Smith” as part of a “Great Economists” conference. But it was the final speaker who created the most controversy – and it prompted some thoughts on the Federal Reserve’s “soft landing” thesis, explains Mark Skousen, editor of Forecasts & Strategies.

Nicholas Wapshott, author of the book “Samuelson Friedman: The Battle Over the Free Market,” claimed that Milton Friedman, the great free-market economist, is passé and completely ignored when it comes to today’s hot economic issues.

He may be right when it comes to Friedman’s monetarism — that the money supply matters. Jay Powell, the current Fed chairman, says he no longer looks at the money supply to determine monetary policy.

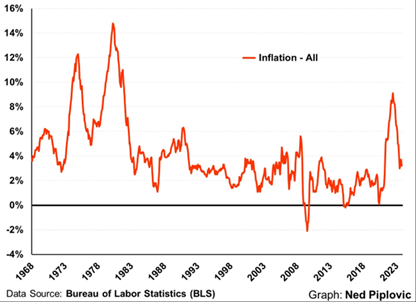

Today, the Fed’s primary tool is interest rates to fight inflation. So far, his policies have worked, and consumer price inflation is coming down, as the following chart demonstrates.

And with Powell’s strategy, the stock market is roaring ahead. (We are fully invested.)

But will his “tight money” policy work in the future? Ah, there’s the rub. In economics, we learn that monetary policy consists of two parts: The quantity of money and the price of money.

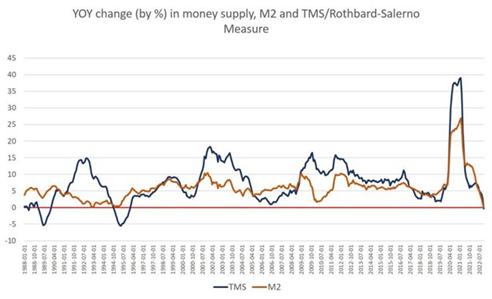

The quantity of money (M2 or M3) should not be ignored, and it is sending out warning signs. As the following chart shows, the broad-based money supply has been extremely volatile since 2020. It ballooned during the COVID-19 pandemic in 2020-21 and has collapsed in 2020-23.

It was the “easy money” policies of the 2020-21 period that caused the return of inflation, and now it’s the Fed’s “tight money” policy that is bringing inflation back down. But it could also cause a deep recession if it continues.

In order to have a soft landing — stable economic growth — the Fed needs to adopt Milton Friedman’s Monetarist Rule: Increase the money supply at a stable rate close to the long-term economic growth rate of 3-4% a year.

Unfortunately, the Fed is moving in the opposite direction of an unstable “easy money/tight money” policy, what I call the Fed Disaster Plan. The longer the money supply remains stagnant, the more likely we will see a recession, probably in 2024. In short, the Fed is perpetuating the boom-bust cycle.