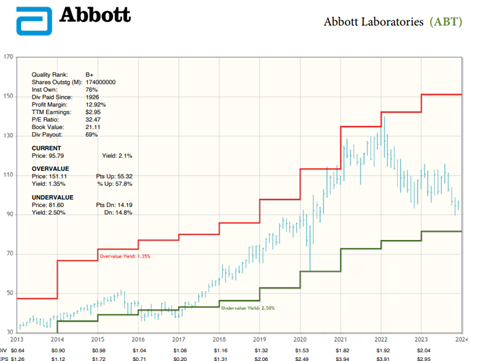

Subscribers recognize there is a natural pattern of ebb and flow in markets, which in IQ Trends-speak is Undervalue to Overvalue and back to Undervalue again. At Undervalue, price is low and dividend yield is high, so buyers are attracted to the value. At Overvalue, price is high and dividend yield is low, so what once were buyers now become sellers to lock in the capital gains. One name I like at this time is Abbott Laboratories (ABT), notes Kelley Wright, editor of Investment Quality Trends.

ABT operates in four reportable segments: Established pharmaceutical products (branded generics), diagnostic products, nutritional products, and medical devices. Combined, these segments generated $43.7 billion in sales in 2022, with 17.1% coming from nutrition, 38.% from diagnostics, 11.3% from established pharmaceuticals, and 33.6% from medical devices.

These diverse operations are due to strategic acquisitions made over the years, as well as from internal research and development (R&D) programs. ABT commands leading market positions for many of the products that it sells. ABT did not make any major acquisitions from 2019 through 2022, though this is following two major acquisitions in 2017.

Although ABT is in a good position to make a major acquisition, the company is expected to focus on its numerous internal growth opportunities and tuck-in acquisitions. The company has recently experienced a lull in their earnings, reporting year-over-year decreases in revenue and EPS. This is largely a result of the company experiencing roughly 36% revenue growth from 2019 to 2022, which in part was due to a boost from Covid tests.

Considering the company was generating close to $8 billion per quarter in 2019 and is now generating about $10 billion per quarter, however, indicates the trend remains up. In the most recent quarter, ABT’s nutrition segment generated an 18% surge in sales. The segment’s total sales reached $2.07B in the U.S. and $1.21B internationally, a 25.4% increase in the US and 9.3% internationally compared to the same period last year.

Established Pharmaceuticals, Diagnostics, and Medical Devices also produced strong sales growth with increases of 11%, 10%, and 15% respectively. ABT’s ROIC, FCFY, and PVR are 8%, 2%, and 2.7 respectively, which indicates its price is ahead of its economic book value.

Recommended Action: Buy ABT.