It was quite a day with the CPI number recently. So, I want to talk a bit about regimes. There are so few clear examples of regime change in the business. From here on out, dips in bonds will be bought, and rallies in the dollar will be sold. And small caps will outperform large caps for the foreseeable future, advises Jared Dillian, editor of The 10th Man.

For most of this year, we were in a strong USD/high-interest rates/long large-cap tech regime. That all changed on the recent CPI Tuesday. Rates were down at least 20 basis points across the curve, and the S&P 500 was up 2%. But the Russell 2000 was up 5% and the dollar took a dirtnap.

I didn’t exactly predict it, but I’ve been leaning in that direction for a while, under the theory of “that which is unsustainable cannot be sustained.” I’m referring to the “higher for longer” trade, which turned into a minor cult comprised of a group of people who thought that rates would stay high forever and go higher.

Well, nothing goes on forever in the markets. Sometimes, it seems like it does, but inevitably, the trend will come to an end. There is an old saying that the trend is your friend. I find this not to be the case for me. By the time I identify a trend, it is pretty close to the end. The trend is your friend if you have an exceptional entry point. So, it is really about getting an exceptional entry point.

How can you get an exceptional entry point? Sentiment, my friends. Sentiment.

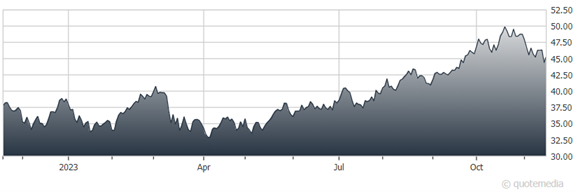

CBOE 10-Year Treasury Note Index (TNX)

There were some loud and annoying bond bears in the last few months. I heard calls for 6%, 7%, 8% yields on 10-year notes and beyond. People are always attracted to the doomsday trade in markets. It is like flypaper for idiots.

Don’t get me wrong: We will one day have doomsday in the bond market because of an inability to contain the federal deficit. But maybe we won’t! Maybe we’ll elect a sane centrist deficit hawk and reduce the deficit to 1% or 2% of GDP. We certainly aren’t tracking in that direction, but it is possible.

In The Daily Dirtnap, I have written about the concept of deus ex machina many times. Sometimes, things magically get better, and everyone gets bailed out. Sometimes, we pull back from the brink. Sometimes, Americans do the right thing after exhausting all other possibilities. Sometimes, demand rises to meet supply. And sometimes, the markets do what you least expect. Happens all the time.

So, anyway, how to get an exceptional entry point…

Watch for “when the noise around something picks up to deafening levels.” It is usually the thing that everyone is fighting over. Right now, we are fighting about bonds. In the past, we have fought about Bitcoin and stocks.

Not too long ago, we were fighting about ESG. Funny about ESG—right when everyone was mad about it, it started to underperform. Now, nobody wants it. It won’t exist in five years.

10-year yields are now down about 60 basis points from the peak. Where do you think they will go?

4%? 3.5%? 3%?

I don’t know, but here is my answer: Probably further than you think.