Founded in 1914, Brady Corp. (BRC) manufactures and markets specialty materials. The company operates in two segments: Identification Solutions and Workplace Safety. Its product lines include absorbents, labels, pipes and valves, signs, tags, tapes, and printers, writes Ben Reynolds, editor of Top 10 Dividend Elite.

Brady generates $1.3 billion in annual revenue and trades with a $2.5 billion market cap. On Sept. 4, Brady increased its quarterly dividend 2.2% to $0.235, extending the company’s dividend growth streak to 38 consecutive years. On September 5, Brady announced results for the fourth quarter and fiscal year 2023 for the period ending July 31.

For the quarter, revenue increased 6.8% to $345.9 million. Adjusted earnings-per share of $1.04 was a company record and compared favorably to $0.87 in the prior year. For fiscal year 2023, sales grew 2.3% to $1.33 billion while adjusted earnings-per-share reached a record $3.64. Organic revenue grew 6.9% for the quarter and 5.5% for the year. The company also announced a $100 million share repurchase authorization.

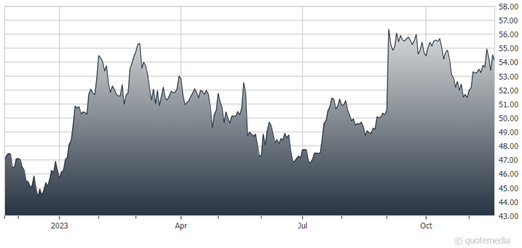

Brady Corp. (BRC)

Brady maintains a leadership position in both of its main product categories thanks to sufficient research and development. The merits of its strong position in its business are reflected in the exceptional dividend growth record of the stock. Brady is a Dividend Champion, with 38 consecutive years of dividend growth.

Thanks to its healthy payout ratio of 24% of expected 2024 earnings and its low-debt balance sheet, the company can easily continue raising its dividend for the foreseeable future. On the other hand, due to its industrial nature, Brady is vulnerable to recessions. We expect Brady to endure any potential downturn and emerge stronger given its past track record, but investors should be prepared for pressure on the company whenever recessionary pressures exist.

Brady grew its earnings-per-share by 10.1% per year from fiscal 2014 through fiscal 2023. Growth was in the double digits in 2021, 2022, and 2023, but we prefer to remain cautious due to the volatile performance record of the company. As a result, we estimate 5% average annual growth of earnings-per-share going forward.

Shares were recently changing hands at 13.1 times expected earnings in fiscal 2024. This P/E ratio is lower than our fair value estimate of 19.0, indicating the potential for a 7.8% annualized valuation tailwind over the next five years. Including the 1.8% dividend yield and 5% anticipated growth, the stock could offer a 14.3% annual total return over the next five years.

Recommended Action: Buy BRC.