Shares of Lowe’s (LOW) fell 2% last week after the home improvement retailer reported fiscal Q3 results that weren’t as strong overall as traders had hoped. But we continue to like that Lowe’s is focused on improving its return on invested capital, streamlining the business, investing in the Pro business, and returning capital to shareholders, notes John Buckingham, editor of The Prudent Speculator.

For the three-month period, adjusted EPS came in at $3.06 per share, which was in line with the consensus analyst estimate. Net sales were $20.47 billion, which trailed the average forecast of $20.9 billion. US comparable store sales declined 7.4% due to lower DIY discretionary spending, but this was partially offset by positive Pro customer comparable sales.

Management tweaked its full year 2024 financial outlook. Revenue is now expected to come in around $86 billion, versus the previous expectation of between $87 billion and $89 billion, with the prior prediction of adjusted EPS between $13.20 and $13.60 marked down to $13.00.

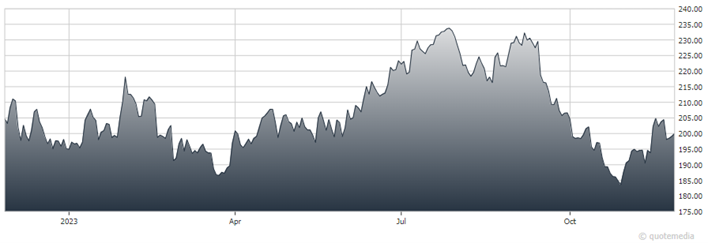

Lowe's Companies (LOW)

CEO Marvin Ellison explained: “In the third quarter, the company delivered strong operating performance and improved customer service despite a greater-than-expected pullback in DIY discretionary spending, particularly in bigger ticket categories.

“Given our 75% DIY mix, the DIY pressure disproportionately impacted our third quarter comp performance. At the same time, our investments in Pro continue to resonate, resulting in positive Pro comps again this quarter. As we look ahead, Lowe’s is committed to offering value and convenience this holiday season, helping our customers save time and money.”

During the quarter, the company generated $5.4 billion in free cash flow and repurchased approximately 7.3 million shares for $1.6 billion (about $219.17 per share). In addition, LOW paid $642 million in dividends.

While Lowe’s will need to continue to adjust to the potential for higher-for-longer interest rates, we know that there are still underlying housing fundamentals that support opportunities for growth. Shares also recently traded for a reasonable 15.3 times NTM P/E multiple and offered a 2.2% dividend yield.

Recommended Action: Buy LOW.