The November rally seems to have paused, at least for a bit. No matter. There is always a way into the fight! Meanwhile, I want to explain why I love stock buybacks, using Kraft Heinz (KHC) as an example, writes Keith Fitz-Gerald, editor of 5 With Fitz.

Many investors don’t like buybacks because they think management should be “investing” in the company rather than buying back its own shares. That’s a mistake. Buybacks increase the true shareholder yield and, in doing so, make your shares considerably more valuable.

Take KHC, for instance. The company just authorized a $3B buyback after what it calls a “milestone” quarter during which management reported a 108.2% jump in free cash flow that topped nearly $2B.

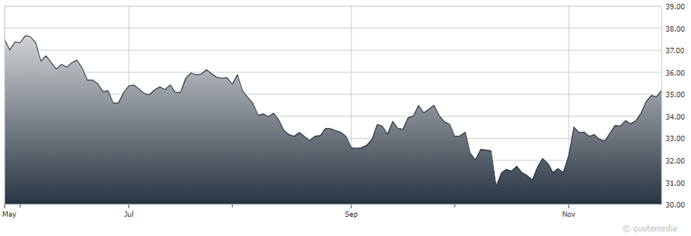

Kraft Heinz (KHC)

Makes sense. The company’s listed yield—meaning what you see on the typical financial website—is 3.44%. But the true shareholder yield ahead of this announcement was 5.7% (Dividend Yield + Buyback Yield + Debt Paydown = True Shareholder Yield).

That’s just gone up. True shareholder yield is a more accurate, important way to measure returns than the commonly cited dividend yield. That’s because it combines dividends, buybacks like the one I’m telling you about, and debt reduction.

In doing so, it allows you to gauge a company’s managerial effectiveness more accurately when compared to other investment alternatives.