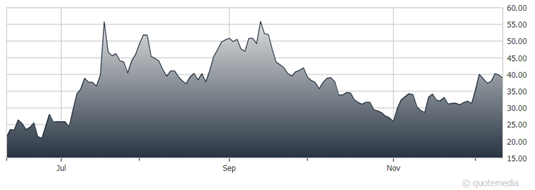

My “Buy List” of stocks has taken a 28% leap forward since Halloween, wiping out its summer weakness in the process. The big question has shifted to how long the Buy List would need before accumulating enough paper profit to be worth locking in. But for now, I still see more upside for Carvana (CVNA), notes Hilary Kramer, editor of GameChangers.

When you’ve got a stock moving up at the speed of CVNA (+14% in a recent week) or SPOT (+9%) or even TWLO (almost +6%) you don’t get in the way while the momentum keeps flowing. And when the momentum temporarily pauses, you buy the dip. That’s how we got into CVNA in the first place and how we’ve made money on the stock in its previous appearances on the Buy List.

As far as I can see, CVNA has what it takes to keep rallying here. There’s nothing in the economic landscape keeping it from at least another test of $55 once it gets going.

Carvana (CVNA)

Admittedly, the stock is extremely volatile. There’s a chance that we’ll retreat to $33 on the way to $55, which exposes our current position to a 20% reversal in that scenario...but a potential 35-40% return makes that risk acceptable.

This is how we weigh our trades, with one eye always on risk. But risk is what you live with on the way to the goal. When we hit our goal, we cash out and the journey ends. Everything else is conviction, discipline, nerve, and just a little good luck.

Right now, with CVNA, I’d happily make this trade 100 times if we earn 35% half the time and lose 20% otherwise. And even if the fleeting downside is bigger than that, we’ve already tolerated it here.

When the bond market crisis was at its worst in late October, we grimaced and held onto CVNA down to $23. A few days later, the stock was back at $35. Here we are now wondering whether the next move takes us back to $33 or up to $55. These are good problems to have.

Recommended Action: Buy CVNA.