I am surprised we have not seen a bout of short-term profit taking yet, but the fact that we haven’t tells me that we’re on the right track. Meanwhile, I couldn’t have been happier to see Costco Wholesale’s (COST) results, notes Keith Fitz-Gerald, editor of 5 With Fitz.

All the buying since October and last week, in particular, suggests there’s even more money on the sidelines than I thought. You and I have been talking about $3-5T…what if it really is north of $10T.

ECON 101 dictates that more money chasing fewer stocks = higher prices over time. Yowza!

Many people would love nothing more than to see the markets charge higher – and to be fair – we’ve gotten a good dose of that lately. While I love that, I want to see some short-term profit taking first. That’s because the markets require buying AND selling to work normally which is why I constantly talk about the give and take that comes with it as an opportunity, not a threat.

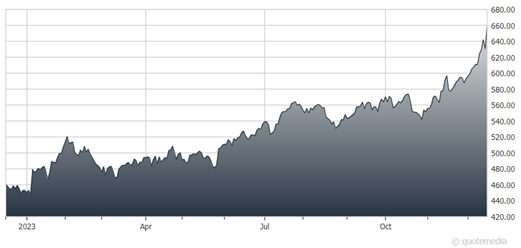

Costco Wholesale (COST)

My POV: Think about stocks like groceries. Occasionally they go “on sale” and that’s when you pounce or buy a little extra.

As for COST, I am particularly impressed with the special dividend (which I’ve told OBAers was in the works for some time now). I also like the fact that the company has repeatedly built upon Covid-era challenges rather than chasing its tail because it’s worried about ‘em.

Shares have returned more than 43% YTD versus around 23% from the S&P 500. I hope I’m smart enough to buy more.