Automatic Data Processing (ADP) is a cloud-based HR capital management solutions platform that operates globally. The company has two operating segments: Employer Services and Professional Employer Organization (PEO), writes Ben Reynolds, editor of Sure Passive Income.

The Employer Services segment offers HR outsourcing solutions, including payroll, benefits administration, talent management, workforce management, compliance services, and HCM solutions. PEO offers similar services to small and mid-sized businesses.

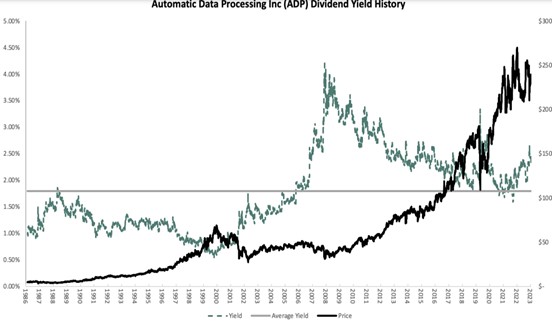

ADP was founded in 1949, generates almost $18 billion in annual revenue, and trades with a market cap of $96 billion. In addition, the company has a 49-year dividend increase streak.

ADP posted first-quarter earnings on Oct. 25, and results were mixed as the company beat on the bottom line, but fractionally missed the top line. Adjusted earnings-per-share came to $2.08, which was six cents better than expected.

Revenue was up 7% year-over-year to $4.5 billion, but missed estimates by $10 million. Employer Services grew 9%, which was driven by strong new business bookings and retention, as well as higher client funds interest revenue. PEO Services revenue rose 3% with new business bookings growth, but margins fell 90 basis points. This was due partly to workers’ compensation reserve adjustments and higher selling costs.

Total expenses were up 7.4% to $3.48 billion. We forecast $9.15 in earnings-per-share for fiscal 2024 after first quarter results. On November 8, ADP increased its quarterly dividend 12% to $5.60 per share. ADP’s dividend safety is outstanding, given it has a high level of predictable earnings, and has limited long-term debt.

ADP’s payout ratio is just over 60% of earnings, so even in the event of a recession, we do not believe a dividend cut would be necessary. ADP’s history of nearly half a century of dividend growth looks to remain intact for many years to come.

Meanwhile, ADP’s earnings per share have risen more than 11% annually on average for the past decade – a highly attractive growth record. We believe ADP can produce 8% growth going forward, which could accrue from a combination of revenue growth, margin expansion, and share repurchases.

ADP is seeing a sizable tailwind from higher interest rates, as the company can earn more interest from funds it holds from its payroll customers. Unemployment remains very low, which means the revenue the company generates remains high.

Recommended Action: Buy ADP.