I recently wrote about three possible scenarios for 2024, each based on previous periods I lived through and invested through. Right now, the story is more intriguing than it usually is at year-end and the outlook for the S&P 500 ETF Trust (SPY) is a bit uncertain, explains Robert Isbitts, founder of ETFYourself.com.

It is worth repeating those three applicable eras -- and what could happen today if this market follows those models:

- 2000: The Invesco QQQ Trust (QQQ) rises sharper and faster than anyone can imagine, and that is the final “blowoff top” of this post-pandemic era (just like we saw with Dot-Coms back then).

- 2008: 2023’s regional bank crisis was swept aside like Bear Stearns’ failure was in 2007. But that only led to a worse situation in 2008 involving banking and consumer woes.

- 2010: Remember investing in 2010? Few do. It was not as memorable as the two periods cited above. But 2010 followed the vicious 37% S&P 500 decline of 2008 and the 26% rebound in 2009, like 2022 and 2023. The S&P 500 gained 15% in 2010, but it was a back-and-forth year, with that entire return coming in the final four months.

We won’t be able to declare that the market is surging toward one of these scenarios immediately. But we can note when hints of them appear. The current stock market action looks more like 2000 every day, with the drek flying higher in price and the quality lagging behind. That’s just a quick observation. January will tell us more than late December. It typically does.

Still, my short-term range for the S&P 500 has been lifted from 4,600 to 5,000. That index, powered by the “Magnificent Seven” stocks, crossed one line in the sand. But I’m still in “show me” mode, looking for a decisive move to 4,900-5,000 to really get behind the “new bull market” narrative.

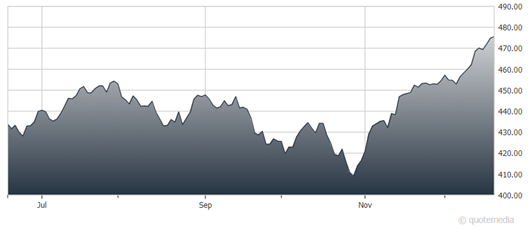

S&P 500 ETF Trust (SPY)

As for why things look intriguing here?

T-bills are still yielding 5.50% at the shortest end and 4.95% for one year. That and the yield curve inversion threatening to re-write the record books are cause for concern, even if that risk is not realized right away.

QQQ is at an all-time high, SPY is nearing one, and the iShares Russell 2000 ETF (IWM) is at the very top of a price range it has been in for 20 months. It all adds up to a great time to let the market tell us what it wants to do. The last time that happened, my “ROAR Score” finally moved up from its two-month home at the 10 level to 25 and then to 35 last week.

As a result, our two-ETF model portfolio is now 35% in SPY (S&P 500) and 65% in the SPDR Bloomberg 1-3 Month T-Bill ETF (BIL). ROAR has not been above 40 since August 2022, back when the S&P 500 was around 4,300. This reminds us that 2023 was more of a recovery year from 2022 to get back to even, not the start of some giant new bull market.