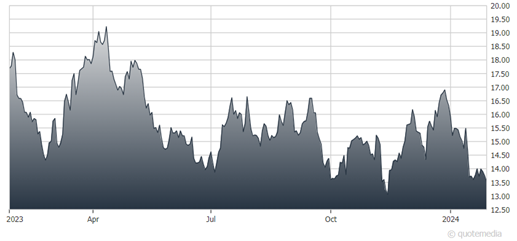

Several resource companies recently provided preliminary fourth-quarter results, with mostly misses on guidance (notwithstanding higher production), higher costs, and weak outlooks for 2024. Market reactions were overdone, however, making for some very good buys. Pan American Silver (PAAS) is one, counsels Adrian Day, editor of Global Analyst.

PAAS had a reasonably strong fourth quarter, but with a weak outlook for the year ahead. In particular, Pan American is forecasting higher costs, before an expected improvement towards the end of the year. Full-year 2023 results include mines from the Pan Am acquisition of Yamana which closed March 31. Gold production was within Pan Am’s guidance, though silver output, up 11%, fell short.

Pan American Silver (PAAS)

With 2024 including a full year of the Yamana mines, the company is expecting another increase in gold and silver production. Going forward, Pan American is separating its mines into the gold segment and the silver segment, with costs on a byproduct basis.

The company is forecasting cash costs for 2024 of $1,181 per gold-equivalent ounce, and AISC of $1,500, about 15% higher than last year. Higher labor costs, including at its Mexican mines, and lower byproduct revenue contributed to the higher cost estimates.

The company still expects further asset sales following its acquisition a year ago of Yamana, as well as improved operations at El Peñon and La Colorada, and an expansion at Jacobina. The potential restart of Escobal appears more possible after improvements in the situation in Guatemala.

The shares, already weak after the high capex estimates for La Colorada skarn deposit announced at the end of the year, fell further on the silver production miss and the cost outlook, taking them close to their five-year lows. But the company has the prospect of additional asset sales to further strengthen an already strong balance sheet, and the potential for improved operations at several mines.

Recommended Action: Buy PAAS.