It’s important to put last year’s robust returns into context. When looked at over two years, the S&P 500 produced a total return of 3.4%, the NASDAQ composite is down –2.4%, and the DJIA is up 8.2%. This is hardly a frothy market, opines Nancy Tengler, CIO at Laffer Tengler Investments.

Following previous bear markets, the average gain in the following two years is approximately 60%. When measured from the October 2022 lows, the S&P is up 32%. This bodes well for stock returns in 2024 (though we may have to wait until the back half of the year).

Earnings growth is on the mend – projected to come in between 10%-12% -- even as economic growth is expected to slow. The bears suggest that a slowing economy will reduce company pricing power and, therefore, earnings. They forget about corporate leverage. Earnings have outgrown nominal GDP by more than 55% since 1980. But they are, it should be noted, notoriously more volatile.

If recent history is any guide, stocks will rally into earnings, retreat on good news, and then work their way back up.

Meanwhile, for at least the third time in the last three years, strategists and commentators have declared the end to the tech trade. While we have said repeatedly all tech stocks are not created equal (in other words, some segments of tech are strategically stronger than others), we have also advocated our theme of buying old economy companies who are pivoting to digital, cloud computing, and generative AI technologies, and the suppliers of the picks and shovels needed to succeed.

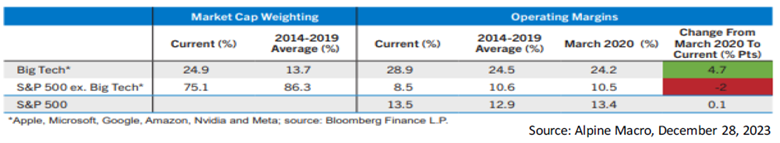

Tech margins remain impervious. And, although the forward p/e for tech is seven points higher than the S&P 500, it remains at the low end of the range over the past decade. Revenues, earnings, and margins are growing much faster than the rest of the market and the secular tailwind behind cloud computing and generative AI should be respected.

Technology spending is 50% of capital spending and seems increasingly less interest-rate sensitive. Add to that when labor is tight, companies spend on technology to increase productivity. We have further argued that this market and economy are analogous to the 1990s.