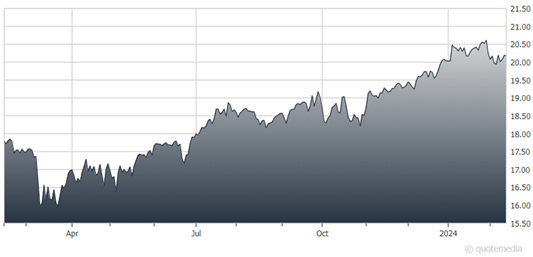

Ares Capital Corp. (ARCC) just reported another strong quarter, with an increase in core earnings, for a record year of $2.37 per share. Although the Business Development Company (BDC) is up over the past few months – it was under $19 at the end of October – it remains a buy for long-term, income-oriented investors, advises Adrian Day, editor of Global Analyst.

Strong credit performance as well as increased revenue from higher interest rates helped in the most recent quarter. The net asset value was up 5% year-on-year to $19.24. Credit metrics remain strong; last year it collected 99% of contractual interest. The company has low leverage.

Ares Capital Corp. (ARCC)

It also ended 2023 with spillover income of $1.09 per share, more than twice the amount of the regular quarterly dividend, putting it in a strong position to continuing the dividend even in a period of temporary revenue declines (as occurred during Covid). The dividend in 2023 was increased by 10% over 2022 and is holding steady for now at 48 cents per share per quarter.

Ares also says it is reviewing a “huge” number of opportunities. The BDC and its peers are grabbing business from banks and traditional lenders. The attraction is their flexibility and speed of approval rather than the actual rates on offer.

Last year, 75% of investments were in existing companies. Ares now has 505 different companies to which it has loans, with no single investment more than 2%, very broad diversification.

Ares, trading just a little above NAV, recently had a yield of 9.6%, excluding occasional additional distributions. While BDC stocks tend to be volatile, the current yield is very attractive. So, if you hold for a long period, the volatility in the share price should not be a great concern.

Recommended Action: Buy ARCC.