Air Products and Chemicals (APD) is one of the largest global producers of industrial gases, as well as a major player in specialty chemicals. It is the world’s leading supplier of hydrogen and carbon monoxide products (HYCO) and helium. APD’s Q1 earnings report was not exactly stellar, but it remains a long-time IQT favorite, counsels Kelley Wright, editor of Investment Quality Trends.

The capital-intensive industrial gases industry has historically expanded up to twice as fast as the overall economy. The company does not have a homogeneous customer base or end market, and no single customer accounts for more than 10% of the company’s revenues.

However, APD does have concentrations of customers in specific industries, primarily refining, chemicals, and electronics. Within each of these industries, APD has several large-volume customers with long-term contracts.

In November 2023, APD announced that the new capital budget for its blue hydrogen energy complex in Louisiana is $7 billion, an increase from $4.5 billion in October 2021. Much of the increase is driven by cost inflation, including the interest component of capital in the budget, and a smaller amount of the increase is driven by an expanded scope, supported by strong demand.

Okay, so that’s the boilerplate. Moving on, in Q1, the company missed estimates, guided EPS lower, and reiterated its hefty capital expenditure commitment for 2024. Next, revenues did grow quarter-over-quarter, but the company’s rolling three-year free cash flow margins turned negative.

Peers L’Air Liquide S.A. and Linde Plc (LIN) were able to grow their free cash flow margins over the same period. The company’s three-year rolling capital expenditures exploded to three times those of their peers. Moody’s is suggesting a possible downgrade in its credit rating, and the dividend increase was lower than in previous years.

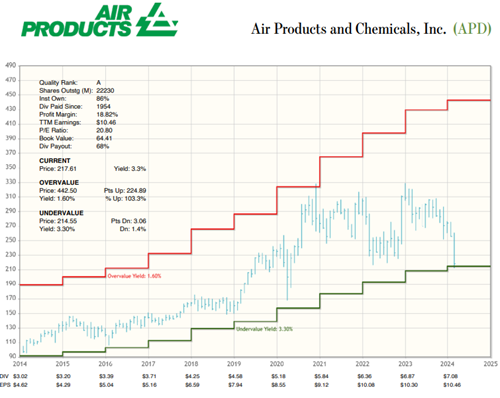

APD has recently returned to the “Undervalued” category after many years. But with economic book value of just $116 per share based on an ROIC of 9%, an FCFY of -6%, and a PVR of 1.9, it may take a while for the company to get right.

Recommended Action: Buy APD