Franco-Nevada Corp. (FNV) reported mixed results for the fourth quarter, though it met its revised full-year guidance and analyst expectations following the closure of the Cobre Panama mine (its largest asset), as residual sales from that mine were higher than anticipated (though oil and gas fell). FNV remains our top holding in the gold space, says Adrian Day, editor of Global Analyst.

Gold-Equivalent Ounces (“GEOs”), taking out Cobre Panama, were up on the prior year. Cobre Panama, however, provided the major news, as Franco decided to take a full impairment, recognizing a loss of $1,169 million.

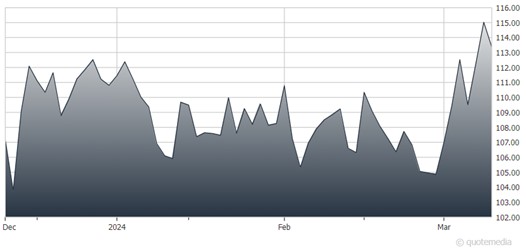

Franco-Nevada (FNV)

From here, there is only upside, either from a restart of the mine or from arbitration. Franco said it had notified the Panamanian government of its intention to initiate international arbitration (separate from that of mine owner First Quantum), with a claim for at least $5 billion. There is some hope that fresh contract negotiations could be launched after a new government takes office in May, but any restart of mine operations will not happen quickly.

Meanwhile, Franco issued 2024 guidance omitting any contribution from Cobre Panama in a range of 480K to 540K GEOs, a modest increase on 2023 (ex-Panama). This includes initial ounces from three major new mines, Greenstone in the second quarter, and Tocantinzinho and Salares Norte in the second half.

The company also continues to add to some existing royalties and bought a new royalty portfolio on Haynesville gas properties. It also noted plans for expansions at several major mines on which it holds streams, including Antamina, Candelaria, and Detour Lake.

Franco ended the year with cash of $1.4 billion, no debt, and $1 billion available on its credit facility. However, it also said that its exposure risk in its ongoing Canadian tax reassessment has increased to $559 million. It increased its dividend for the 17th consecutive year.

Franco remains our top holding in the gold space, with a solid balance sheet and management, broadly diversified assets, and a deep pipeline. Some high-quality mines on which the company holds royalties or streams are coming on stream over the next couple of years. Several expansions are planned for major mines in the years ahead.

Plus, Cobre is now all upside potential, either from a mine restart or an arbitration award. Although the stock has bounced off its lows with the gold price movement, the lows were a gross exaggeration, and the stock remains a buy.

Recommended Action: Buy FNV.